From the ‘need for speed’ to deliver groceries in 10 minutes, quick commerce spent the latter half of 2022 in search of its Ikigai. The sector also came under scrutiny as delivery partners protested the time-linked incentive structures adopted by startups in the space.

Cut to the present, the average delivery time for quick commerce has moved to 20-30 minutes, with startups incentivising users to opt for delivery in 60-90 minutes. This is also aimed at cutting down expenses borne by these service providers on a per-order basis.

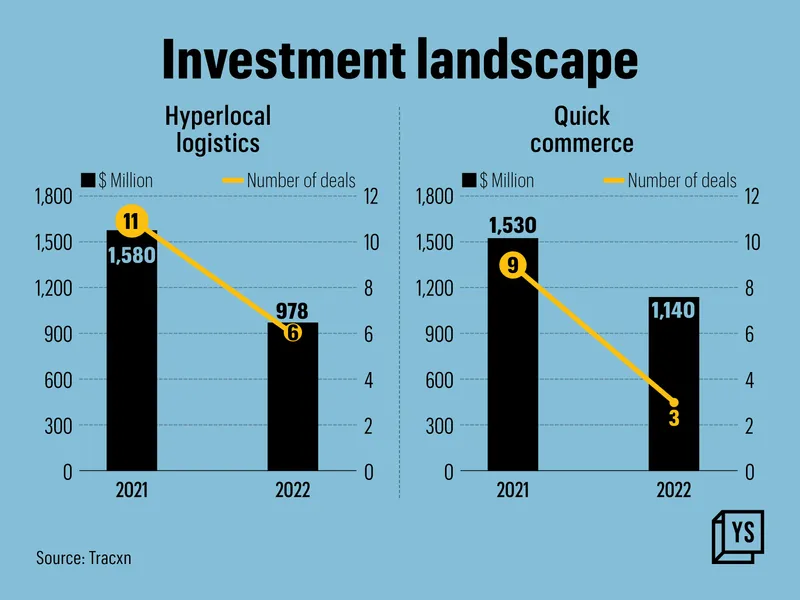

This year, investment in the sector too shrunk from $1.53 billion in 2021 to $1.14 billion, according to data by research firm Tracxn. And with a funding winter that shows all signs of continuing in 2023, it is unlikely that this number is going to go up anytime soon.

Hyperlocal continues to be a tricky piece of logistics too as food, grocery, and Direct-to-Consumer (D2C) brands want to target shorter delivery times. However, customers expect faster deliveries but the intent to pay for the service varies. Further, the payout structures for delivery partners are unlikely to change in 2023, according to industry experts.

Setting customer expectations right

In an earlier interview with YourStory, Kabeer Biswas, Founder-CEO of Bengaluru-based said that the business saw half of its orders being delivered in 12-13 minutes.

“We don’t see any consistent difference in click-through rates, conversion or retention for those getting their orders in 12 minutes…We are very happy saying that customers should transact with us not because we are just quick, but because we deliver on selection, quality and price,” he said.

The Chief Operating Officer of Tata-backed echoes these sentiments, adding that nearly 96% of the orders under BBNow were serviced under 26 minutes.

Slowdown in quick commerce

Anup Jain, Managing Partner at , says that the venture capital firm has stayed away from the quick commerce model as it is not sustainable and people aren’t willing to pay for the service.

“It is difficult to sustain 10-minute grocery delivery without burning huge amounts of cash. The Total Addressable Market (TAM) is not large and the Average Order Volumes are low. The fixed delivery cost for a quick commerce player is no different from a grocery player,” he adds.

He believes quick commerce is essentially a top four-city phenomenon and the typical local kirana store is already able to handle delivery timelines under 30 minutes.

Orios is an investor in the food essentials delivery platform Country Delight, which raised $108 million in May.

Investment landscape of hyperlocal and quick commerce

No change for gig workers

The year 2022 saw a lot of conversations around the working conditions of gig workers, which includes these companies’ delivery executives who are the backbone of the segment.

And while delivery timelines have decreased, these delivery partners continue to work on an incentive-linked payout, which takes into account the number of orders fulfilled in a stipulated period of time and the time taken to deliver the order, among other factors.

“The demand for delivery partners has increased over time. However due to the squeeze on unit economics and bottom-line, there is no increase in salaries,” says Vikram Bhaskar, Chief Business Officer at frontline workforce management platform, .

He adds that as hyperlocal deliveries account for 40% of business in ecommerce, the volume of orders will continue to increase, with more customers coming from Tier II cities and beyond. This will not translate into better salaries for gig workers though many startups are now willing to extend term and accident insurance to them.

So far, they are not doing so well. In the ‘Fairwork India Ratings 2022: Labour Standards in the Platform Economy’ report released earlier this week, Dunzo scored no points while Bigbasket scored 6, Flipkart, Swiggy, and Zomato scored 5 each, and finally, Zepto scored 2.

Hyperlocal deliveries to grow

However, the hyperlocal sector is only set to grow—deliveries within a fixed radius in typically 30-40 minutes.

Hyperlocal logistics, with the exclusion of quick commerce, saw an investment of $978 million in 2022, down from $1.58 billion raised in 2021, according to data shared by Tracxn.

The sector is driven by multiple factors, including quick commerce, omnichannel strategy adopted by retail brands, the push from D2C brands, and the launch of the government’s open network for ecommerce, .

, the shipping and logistics software platform for ecommerce, also anticipates its customer brands to speed up deliveries within top cities for customer retention.

“We are piloting 30-40 minute deliveries with footwear brand Bata. Hyperlocal deliveries in the D2C and retail segment are viable for high-end brands where the Average Selling Price (ASP) is around Rs 4,000, where the propensity for a customer to pay for premium delivery experience is higher,” says Atul Mehta, Chief Operating Officer at Shiprocket.

He adds that customers aren’t necessarily looking for 30-minute deliveries from mass D2C brands but expect faster deliveries, ranging across four-hour delivery, Same Day Delivery (SDD) or Next Day Delivery (NDD). Speedy deliveries also help brands reduce returns by a significant margin.

“Whether it is 10 minutes or 30, the hyperlocal delivery model is the key to quick commerce and it’s here to stay. However, a 10-minute delivery promise comes at a huge cost, which is hard to sustain over a period. While it helps to attract customers initially, one has to move to more sustainable delivery times in order to stay in the game,” says Nikhil Suresh, Co-founder and Director of operations at .

The platform, which started out as an intra-city trucking aggregator, offers micro warehousing services within key city areas and delivery within an 8-kilometre radius. It works with players across food, grocery, lifestyle, pharmacy, electronics, and others.

The year-ahead

Quick commerce is already moving towards consolidation, as witnessed by Zomato’s acquisition of quick commerce player Blinkit. But things are great for everyone. Earlier this year, Ola decided to shut down its grocery delivery service along with other minority businesses, and 2023 promises even more churn in the sector, according to industry observers.

For the hyperlocal logistics space, investments in ancillary fields are likely to pick up the pace.

“There will be direct and indirect investments in hyperlocal logistics. Indirect investments include mostly supply chain, electric vehicles for deliveries and other sectors. We will continue to see innovation happening in the segment,” says Rohit Sood, Partner at .

Growth in the sector will offer the much-needed customer delight to stay on the platforms.

In the meantime, continue adding to your cart.