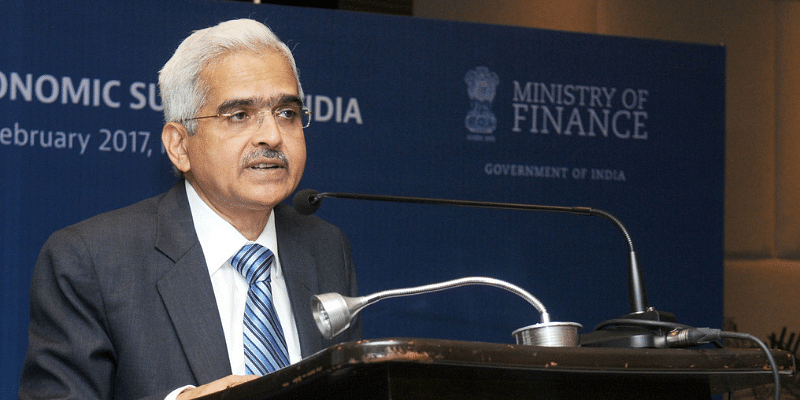

Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday said the Central Bank is taking a “balanced approach” towards formulating new guidelines around BNPL (buy now, pay later) and digital lending, which will come out in the next few days.

During a fireside chat at the Bank of Baroda Annual Banking Conclave 2022, the Governor said that a committee has been set up to deal with the issue. The recommendations by the committee have been examined and the new guidelines in this regard will be issued shortly.

“There are a large number of unregulated and unlicensed entities which are doing various kinds of lending. There are also licensed entities who are entering into activities they are not supposed to undertake,” he said.

Speaking on striking a “delicate balance” between supporting new-age innovations and controlling risks, the Governor said, “This (issuing new guidelines) has taken us more time than what we initially had in our mind. The situation is so complex, that we are being very careful and cautious. On one hand, we have to support innovation, a new product, or a new approach, and on the other maintain financial stability and see that undue risks or leverage are not built up. So we are dealing with the issue very carefully.”

The Central Bank, in June, had barred non-banks from loading credit lines into prepaid payment instruments (PPIs), typically e-wallets. Most of the BNPL players offer credit via their own NBFCs or by tying up with non-banks to offer small loans.

The master direction has pushed some fintech lenders to cease offering loans and halt services, as they mull over pivoting their business amid uncertain future.

Many fintech industry bodies (Payment Council of India, Federation of Indian Chambers of Commerce and Industry and Digital Lenders’ Association of India) had reached out to the central bank to seek clarity regarding the non-PPI guidelines.

Collaborative and competitive

The governor touched up the need for technology upgradation by traditional banks via self upgradation or collaboration with fintechs, to stay relevant in the system.

“The increased adoption of technology by traditional banks via self upgradation or collaboration with fintechs is resonating with the idea of new-age banking. This is leading to innovative products and new business models. In this context, it is often cited that banks will face competition from fintechs which are already making their presence felt within the financial services space,” he said.

This calls for significant investment in technology and collaborative opportunities, and the “RBI is committed to build an enabling environment to accommodate the new disruptive innovations in a sustainable manner while preserving financial stability,” the governor said.

![Read more about the article [Rare Disease Day] Here is all you need to know about why this day matters](https://blog.digitalsevaa.com/wp-content/uploads/2021/02/Image8fjb-1614433426600-300x150.jpg)