The Indian economy is on an upward trajectory, but so are the costs of healthcare. Rising medical expenses, fueled by advanced treatments and an increasing prevalence of chronic and lifestyle diseases like diabetes, heart ailments, and even mental health issues, are creating a significant financial burden for many individuals and families. This is where health insurance emerges as a silver ray of hope, offering a solution to bridge the gap between rising healthcare costs and accessible care.

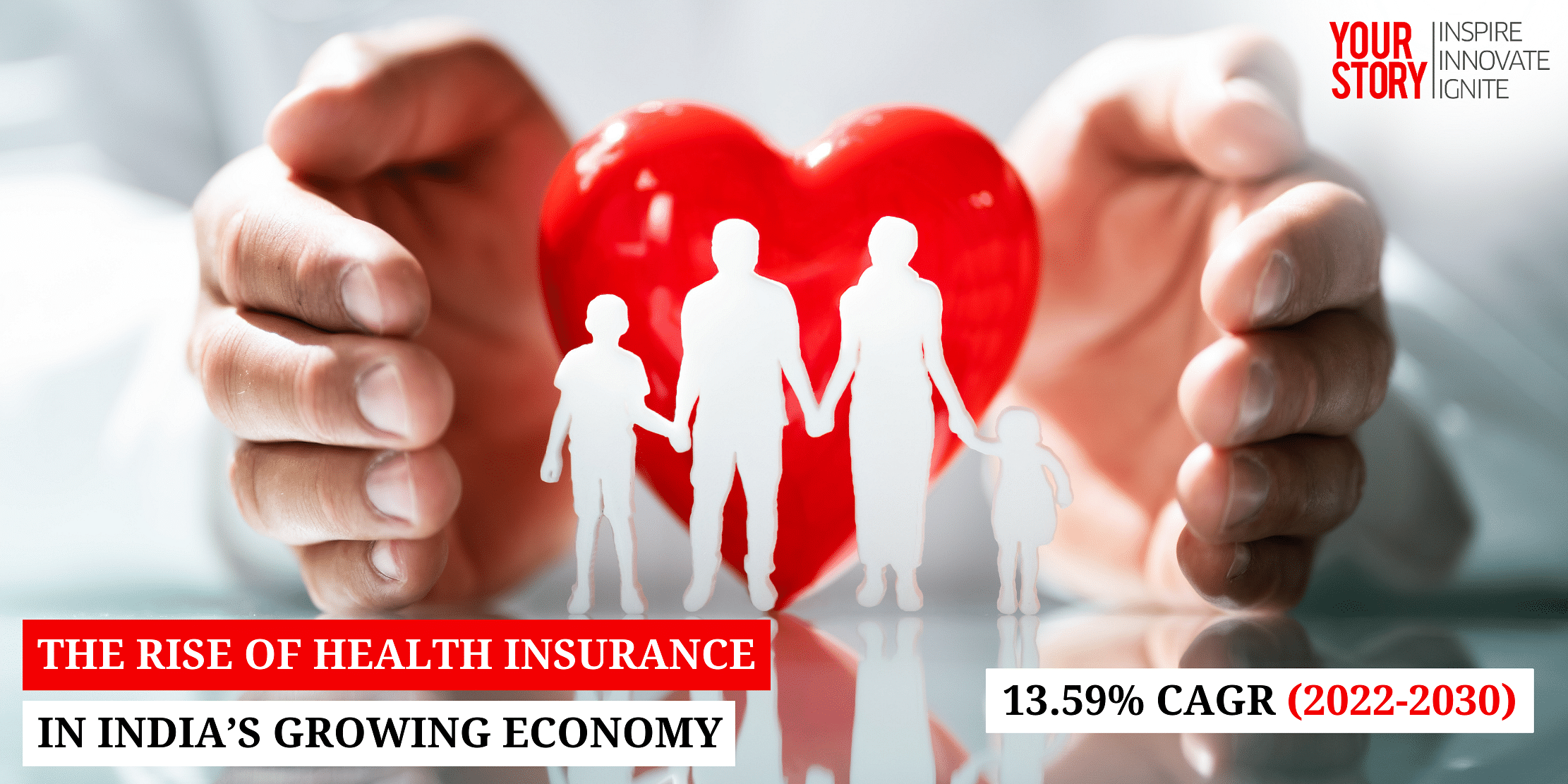

This presents a compelling investment opportunity within the Health Insurance Market, which is expected to exhibit a robust compound annual growth rate (CAGR) of 13.59% between 2022 and 2030. According to Infinium Global Research, the value of India’s Health Insurance Market is poised to grow from USD 8.95 billion in 2022 to an impressive USD 24.77 billion by 2030.

What is Driving the Growth of the Market?

Rising Healthcare Costs: As the cost of medical care outgrows individual income growth, individuals are increasingly turning to health insurance for financial security. Furthermore, rising medical inflation coupled with an aging population further contribute to the increased demand for affordable healthcare solutions.

Government Initiatives: Government-backed schemes like Ayushman Bharat are promoting wider access to affordable health insurance, expanding the market base. These initiatives play a pivotal role in expanding the reach of health insurance coverage across diverse socio-economic segments. Additionally, collaborations between the government and private players are fostering innovation and product diversification within the market.

Employer-Sponsored Insurance: As companies increasingly view employee well-being as a strategic imperative, offering health insurance as part of employee benefits packages is becoming more common. This trend creates a vast and growing insured population, further fueling market expansion.

Heightened Awareness: Rising awareness of lifestyle diseases and the importance of proactive healthcare management is driving demand for comprehensive insurance solutions. Moreover, growing internet penetration and health literacy campaigns have empowered individuals to take charge of their well-being, leading them to consider health insurance as a crucial tool.

Tax Benefits: Investing in health insurance offers attractive tax deductions, incentivising individuals and businesses to participate in the market. Recent tax reforms have further increased these benefits, making health insurance an even more appealing option for tax-conscious consumers.

Expanding Middle Class: The growing middle class with higher disposable income signifies an increasing demand for quality healthcare and associated insurance solutions. This segment is also receptive to new technologies and digital adoption, presenting opportunities for innovative insurance products and distribution channels.

Tech-Savvy Generation: The educated youth actively seek healthcare solutions, presenting a receptive market for innovative insurance products. This tech-savvy generation embraces online platforms and mobile apps, making digital-first insurance solutions particularly attractive.

Lifestyle Disease Awareness: Rising awareness of chronic illnesses like diabetes and heart problems underscores the need for proactive healthcare management, driving insurance adoption. Additionally, growing awareness of mental health issues opens up avenues for specialised insurance products catering to this segment.

Conclusion

Investing in India’s health insurance market goes beyond mere profit; it empowers millions to access quality healthcare. By participating in this dynamic sector, investors can contribute to a healthier and more secure future for India. While challenges persist, market players have abundant opportunities to capitalise on the growing demand for health insurance, cater to diverse customer segments, and drive sustainable growth in the years to come.

Edited by Roshni Manghnani

![Read more about the article [Startup Bharat] How Kochi-based Riafy developed an industry-agnostic AI platform to win over 40M users](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/CopyofImageTagsEditorialTeamMaster19-1639483013314-300x150.png)