“This is the best of times to be an entrepreneur in India and start your own D2C business,” said Aman Gupta, cofounder and chief marketing officer of Delhi-based consumer electronics startup boAt, during a fireside chat. Gupta was speaking at Inc42’s D2C Summit 2021, held on July 17th and 18th, to take a deep dive into the burgeoning business model and its many adopters.

Gupta’s observation rang true. In a market brimming with investor optimism and full of competent third-party resources for every business operation — from full-stack development to payment solutions, from logistics to marketing and more — one only needs to zero in on a good product/service to start up.

But there are more reasons to cheer, it seems. After some time, businesses (yes, even digital-first, direct-to-consumer brands that are more agile than legacy companies) can become too complex and require a new playbook. To help D2C brands deal with financial, operational and other roadblocks, a new set of enablers are now here for ‘entrepreneurship acquisition’. Popularly known as ecommerce roll-ups, these new-age brand aggregators acquire promising D2C companies to ensure operational excellence and fast growth, thus creating value for investors.

Understandably, this format is quite different from traditional venture capital operations as VCs invest in all sorts of startups (both online and offline) and provide strategic guidance, but founders run the show. In contrast, the roll-ups acquire online prospects, provide infrastructural assistance and rope in experts for the best possible execution to take businesses to new heights. India has already seen many players such as Bengaluru-based 10Club, Mensa Brands, G.O.A.T Brand Labs and Pune-based kidswear unicorn FirstCryenter enter this space.

Historically speaking, the format reminds one of the strategies followed by brothers Oliver and Marc Samwer, cofounders of Berlin-based Rocket Internet, who used to acquire large stakes in digital ventures, focussed on execution and finally, sold them off. Experts, however, think that Indian players are looking at a Thrasio-like model to drive D2C growth.

Although the roll-up model has existed in the offline space for years, its extension to digital brands has been made popular by Massachusetts-based Thrasio, the fastest unicorn company in the US. One of the largest acquirers of Amazon sellers, it created a new wave of players that focusses on acquiring and working with businesses that have a strong revenue model and have a high potential product. With the D2C ecosystem on the rise, India is on track to being a lucrative market for these players.

Unsurprisingly, ecommerce roll-ups are gaining popularity as they provide a unique opportunity to businesses looking for early exits minus the hassles of fundraising and valuation. VC-backed startups often wait a long time for a good price or good returns for investors, but due to the Covid-19 pandemic, most companies today do not have enough runway to wait it out. Also, many online sellers and small-to-medium D2C brands face constraints as they lack a cohesive growth strategy in spite of selling good products. All these businesses can easily benefit from the roll-up model.

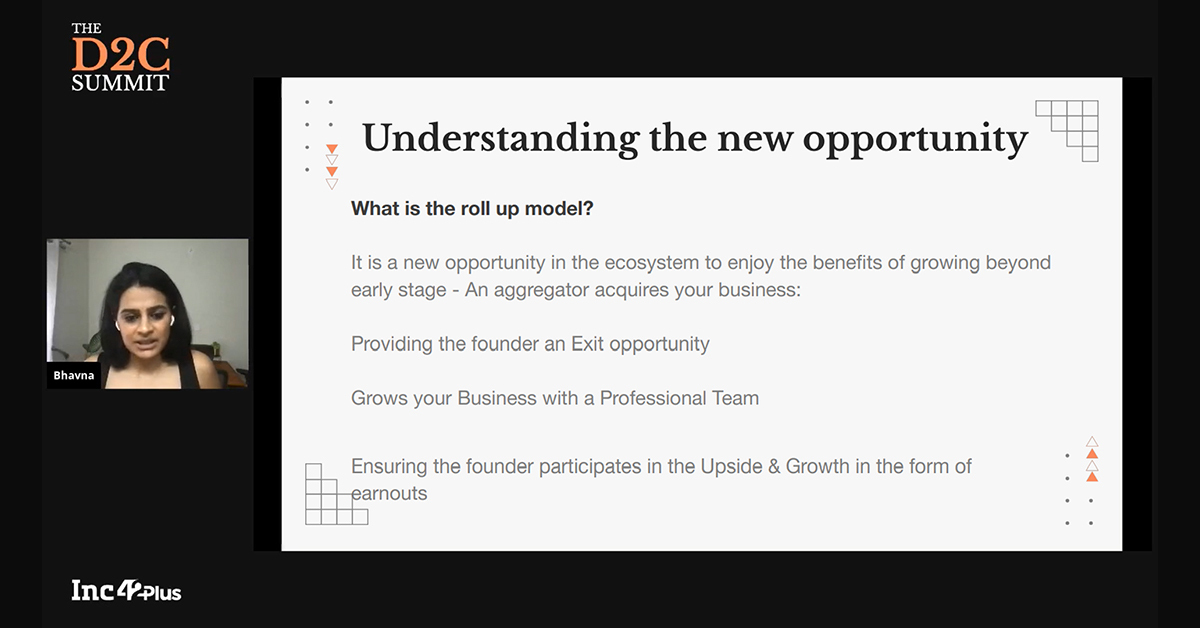

Given its relevance in today’s context when many small brands are literally gasping after the Cambrian explosion of 2020 (most small businesses jumped on the digital bandwagon to survive the pandemic but they were not prepared for the long term), Bhavna Suresh, cofounder and CEO of 10Club, discussed the roll-up model in great details at the Inc42 D2C Summit. In her carefully crafted masterclass hosted on the second day of the event, she explained its format, thesis and how it could benefit D2C founders looking for liquidity but still wanting their brands to succeed.

The Many Faces Of Growth

Building a business is a continuous process that goes through multiple phases. From setting up the operations to finding the product-market fit to scaling up and growing, every phase is part of an evolution that encompasses three fundamental pillars — people, processes and product/s.

Suresh started her masterclass by explaining how these three pillars function in growing a business. For instance, when a company is started, the ‘people’ part essentially involves the founding team. At this stage, individuals handle multiple roles, and the goal is to find the right product-market fit. As the business expands and operations get more specialised, every unit will require the right profiles to carry out these tasks. According to Suresh, a business will stagnate and fail to reach its true potential if it is not able to make effective hiring decisions.

The second pillar is ‘processes’. For a D2C brand, these typically include manufacturing, marketing, logistics, finance and tech support. But as a business scales up and grows, it is essential to set up new processes and optimise the existing ones. Operations like R&D, brand communication and social media engagement come later in the journey after a brand attains a sizeable market share and gears up to expand. But this is when a business has to tackle the second hurdle to sustain its growth. Its failure to put all necessary processes in place is bound to throw a spanner in the works.

Finally, comes ‘product’, the third pillar of growth. Here, the speaker highlighted the need for ‘change’ to explore new areas/markets and stay relevant over time.

Keeping a sharp eye on new or even dormant trends is critical for a business as it needs to adapt fast to retain its customer base. For example, the wireless earphones market was pretty limited before 2016 when Apple introduced its AirPods. Within a year, all major brands came out with their wireless earphones so that their customers would not shift to Apple and AirPods. Using strategic foresight to identify business opportunities (as was the case with AirPod) is also vital for D2C brands that operate in fast-changing and highly competitive consumer markets.

Nurturing these three pillars of growth is key to optimising one’s business, but growth will be elusive without access to suitable funding. Again, capital investment in businesses has undergone an evolution over time. In the beginning, there was individual wealth to grow one’s venture. Next came all sorts of institutional loans, especially debt financing, followed by VC funding, an easier route to capital where repayment happens through equity.

“Today comes the fourth pillar for growth — the roll-up model. But it only comes when there is a thriving ecosystem. And it is a testament to the rising D2C ecosystem in India that has allowed players like us to come in,” said Suresh.

The Roll-Up Play

According to Inc42’s report, the total addressable market in the D2C segment currently stands at $44.6 Bn and is projected to reach $100 Bn by 2025. However, this fast-paced growth in the past few years indicates that many of these businesses are now well beyond early-stage development. They either need substantial funding or viable exits (say, through a roll-up model) so that the brands would continue to thrive for years despite a stake-related or ownership metamorphosis. Incidentally, early money is most expensive, and many founders have to bear the brunt of equity dilution due to huge VC funding. In contrast, the second route seems easier to adopt, given its fast implementation and clear-cut methods, unlike VC funding with its many trappings. Better still, founders can also work jointly with roll-up players and leverage the infrastructural and expert opinion based support to scale a business.

According to Suresh, several misconceptions exist around the roll-up model, and people often find it difficult to differentiate the strategy from VC funding. For instance, a roll-up player works closely with a business and offers expert assistance and resources for active scaling. But in VC funding, businesses only get the money and some strategic guidance. (Of course, founders keep their ‘ownership’ as well.)

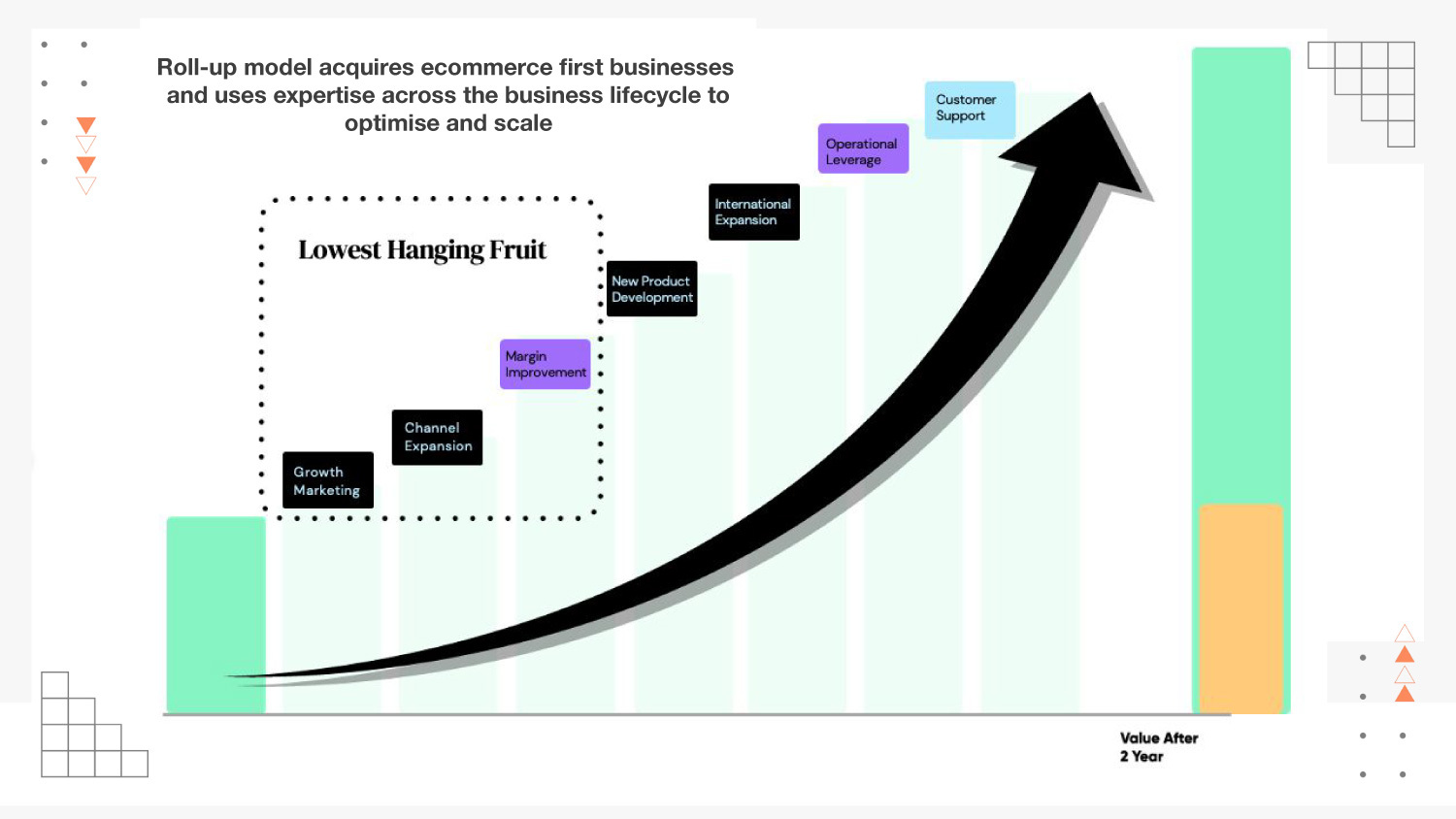

She said that a roll-up player would usually come in to help with the ‘people’, ‘processes’ and ‘product’ pillars after a business found its product-market fit and started generating a steady revenue flow, but still struggled to grow.

Suresh explained the structure of a typical roll-up model collaboration. It can be divided into three parts — the deal, the integration and the growth phase. During the first stage, when a roll-up player gets into a conversation with a business, the former tries to understand the unit economics of the business from the founder. After that, both parties agree upon a deal structure to determine whether the founder/s will exit altogether or there is a scope for jointly building and scaling the business.

Once the deal is agreed upon in the integration phase, the roll-up player drafts all ancillary agreements and begins understanding the business from an analytical perspective to know the vendor details, capital flow, expenditures, team structure, procurement patterns and more. This phase also solidifies the legal terms and puts the fundamental structure in place for both parties to work together.

Next comes the growth phase, when the roll-up player comes in and takes charge of certain or all functions, as per agreements. There will be a merger of teams to work with the founders, and new processes are developed to optimise the scaling of a business.

All this may not be as simple as it sounds because every business is unique. Be it the founders’ journey or the product narrative, there exists a secret sauce behind every brand. But when one zooms out and looks at a business with an objective lens, there are some basic blocks that are common to all digital-first companies such as process optimisation, product innovation, pricing, growth marketing and more.

So, there is a need to unlock the true growth potential of a business, said Suresh. The roll-up model attempts the same, and while retaining the uniqueness of a brand, it tries to remodel the growth pillars for optimum outcomes. She also emphasised that companies should take time during the ‘deal’ stage of the collaboration as it would be essential to understand and re-evaluate the needs of the business before taking a decision.

“Businesses entering roll-up play have to understand their motivation. It can’t just be financial. The right motivation comes with the right balance between financial interest and business aspiration, and that is the only way a business can unlock its potential,” said Suresh.