The inaugural season of the popular business reality show Shark Tank India has led to a remarkable increase in the valuation of startups that appeared on the show, according to a report by Redseer Strategy Consultants.

The study reveals that most startups featured on Shark Tank India—the adaptation of the American reality show—secured deals with external investors at 6X greater value and within a span of 1.5 years.

Redseer’s analysis focused on companies that either secured deals or faced rejection during Shark Tank India season one. The show features entrepreneurs presenting their business ideas to a panel of investors, known as “The Sharks,” who decide whether to invest in their companies.

The study found that a total of 27 startups successfully secured funds from external investors in season one, irrespective of their outcome on the show. The majority of the startups demonstrated notable progress, securing better deals and experiencing a surge in valuations.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

In season one, a total of 32 startups participated, out of which six successfully secured funding from external investors, resulting in a combined deal value of Rs 19.5 crore. The companies that secured deals outside of the show included On2Cook, Theka Coffee, Good Good Piggy Bank, SweeDesi, Sabjikothi, and Nuskha.

In season two, out of 65 startups that appeared on the reality TV show, 16 were able to secure funding from external investors, amounting to a total deal value of Rs 70.7 crore. Startups including Insurance Samadhan, Tagz Foods, Hair Originals, Humpy A2, Ariro, AyuRythm, Grow fitter, Proxgy, Beyond Snack, Let’s Try, Bummer, The Yarn Bazaar, BluePine Industries, Altor, Raising Superstars, and Get a Whey secured deals outside the show.

In season three, 20 startups participated, and five were successful in securing funding from external investors, resulting in a total deal value of Rs 28.3 crore. The companies that secured deals outside of the show included Moonshine Meads, Qzense Labs, Ketolndia, ExperentialEtc, and Aliste Technologies.

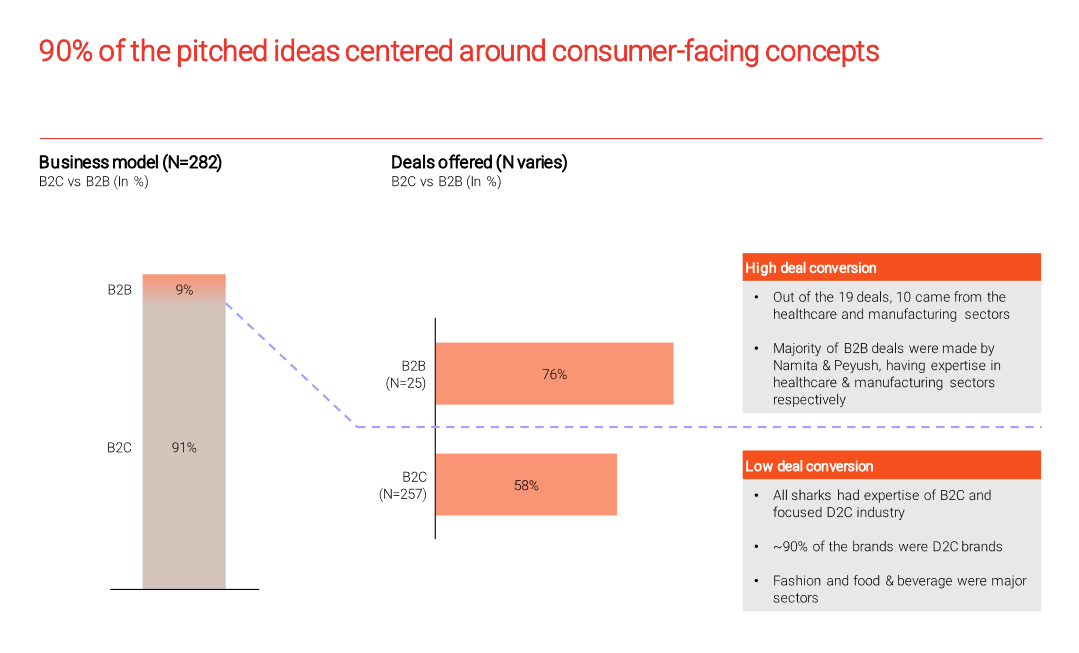

Consumer-facing concepts dominated the pitches on Shark Tank India, with 90% of the ideas centred on this segment. The remaining pitches focused on business-to-business (B2B) concepts.

<figure class="image embed" contenteditable="false" data-id="520579" data-url="https://images.yourstory.com/cs/2/ebefb4a0b2a011edb86579ca40e04503/Screenshot2023-07-11163306-1689074021440.png" data-alt="sharktank redseer chart" data-caption="

Chart by Redseer

” align=”center”> Chart by Redseer

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

“Out of the 19 deals, 10 came from the healthcare and manufacturing sectors. The majority of B2B deals were made by Namita (Thapar) and Peyush (Bansal), having expertise in healthcare and manufacturing sectors respectively,” said Kanishka Mohan, Partner at Redseer.

The investors secured significantly better equity deals than initially pitched on the show, the report noted.

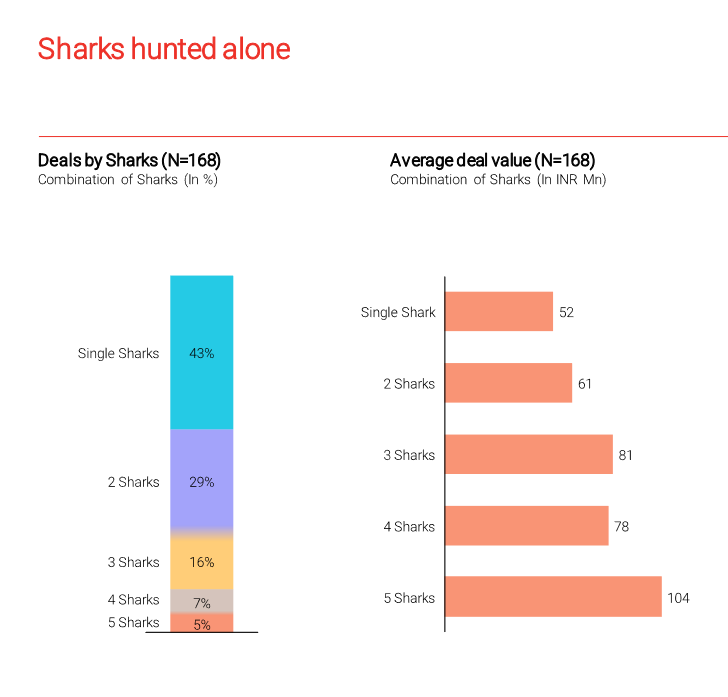

Aman Gupta emerged as the most active shark, securing 70 deals with a total investment of Rs 24.6 crore. Following closely behind were Peyush Bansal and Namita Thapar, securing 67 and 62 deals with total investments of Rs 21.5 crore and Rs 20.6 crore, respectively.

<figure class="image embed" contenteditable="false" data-id="520578" data-url="https://images.yourstory.com/cs/2/ebefb4a0b2a011edb86579ca40e04503/Screenshot2023-07-11163954-1689073919393.png" data-alt="chart sharktank redseer" data-caption="

Chart by Redseer

” align=”center”> Chart by Redseer

Among the eight sharks who appeared on the show, six preferred investing in the food and beverages industry, while the remaining two focused on healthcare.

The combined investments made in both seasons of Shark Tank India amounted to approximately Rs 106 crore, with the food and beverages sector receiving the largest share of investments. Although most deals featured only one shark onboard, there were no instances of all the sharks investing in a single business.

Redseer’s analysis further revealed that the majority of the entrepreneurs who pitched on Shark Tank India hailed from metro cities and had studied in prestigious institutions such as the Indian Institutes of Technology (IITs) and premier B-schools.

While most of the businesses were headquartered in metros, some were situated in Tier I and II cities or smaller towns. Additionally, Redseer noted that a significant portion of the pitched startups had been in operation for more than two years.

Edited by Kanishk Singh