Funding

50Fin raises $550,000 from Arali Ventures

Fintech startup 50Fin has raised $550,000 in its latest funding round led by Arali Ventures and Nitin Gupta.

This influx of capital will fuel the startup’s expansion plans and technological advancements.

Founded in 2022 by Aditya Srinivas Prasad and Darpan Tanna, 50Fin provides solutions to both consumers and non-banking financial companies (NBFCs).

Following its initial raise of $500,000 from investors including 100X.VC, Arun Venkatachalam and Keynote Fincorp in 2023, the company claims to have experienced exponential growth, with its distribution capacity surging by over six times.

“We have also launched our B2B vertical, which allows Banks and NBFCs to digitise LAS (lending against securities) for the clients while completely automating the entire operations of the product,” Prasad said, adding that the company is on track to reach profitability in the next 12-16 months.

Other news

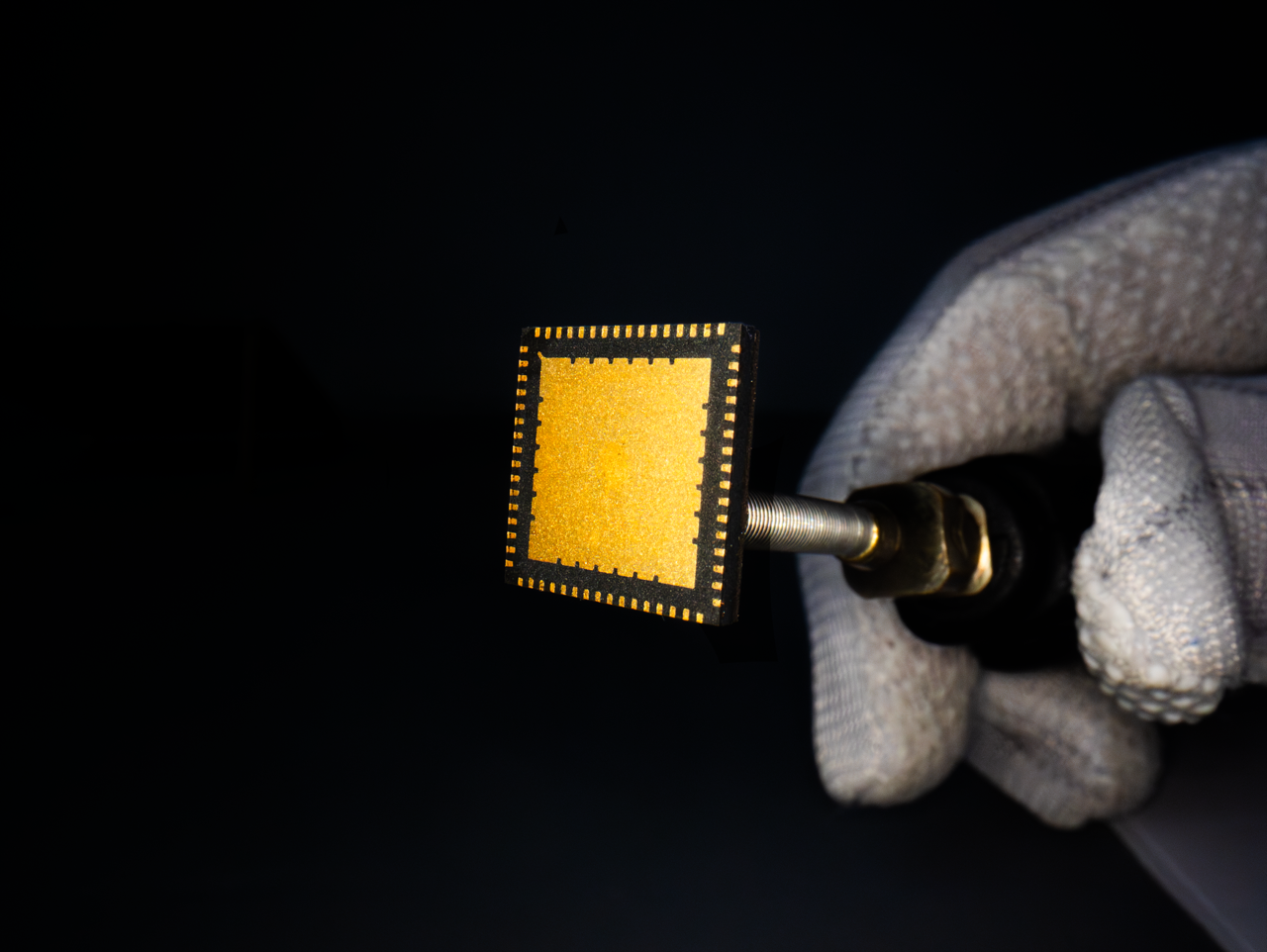

Mindgrove launches India’s first commercial MCU chip

Mindgrove Technologies, a fabless semiconductor startup, has launched India’s first commercial high-performance SoC (system on chip) named Secure IoT.

The RISC-V-based chip will allow Indian original equipment manufacturers (OEMs) to use an Indian SoC in their products and help reduce the cost of their feature-rich devices, without compromising on high-end features. The chip is estimated to cost 30% less than other chips in the similar segment.

Secure IoT is a high-performance microcontroller clocked at 700 MHz. The chip is designed to provide programmability, flexibility, security and computing power for controlling applications on a wide range of connected smart devices.

This chip can control wearables like smartwatches, smart city devices like connected electricity, water, and gas meters, and connected home devices like smart locks, fans, speakers, as well as, as well as EV battery management systems and control systems, amongst others.

<figure class="image embed" contenteditable="false" data-id="543998" data-url="https://images.yourstory.com/cs/2/d99b1110116911ed9e63f54395117598/ChipHandLarge-1714980900850.png" data-alt="Mindgrove Chip" data-caption="

Image credit: Mindgrove Technologies

” align=”center”> Image credit: Mindgrove Technologies

VA Tech WABAG launches initiative to empower startups in the water sector

VA Tech WABAG, a water treatment company, has launched BLUE SEED, an initiative designed to foster innovation and support emerging startups in the water sector.

Through this programme, VA Tech WABAG will invest in, nurture, and empower promising startups with innovative water technology solutions that will shape a secure and sustainable water future.

The initiative will identify and invest in early-stage water technology startups with high growth potential and will provide comprehensive support and resources to accelerate the success of these entrepreneurs.

The initiative was launched by Gopal Srinivasan of TVS Group, Chairman and MD of TVS Capital Funds Limited in the presence of Rajiv Mittal, Chairman and Managing Director, VA TECH WABAG.

“Through this initiative, we aim to cultivate a vibrant ecosystem of innovative solutions that can contribute to making the industry more sustainable and in building a resilient future,” Mittal said.

Tech Data to launch capital division in Singapore, Australia, and India

Tech Data has announced the launch of its capital division in Singapore, Australia, and India, offering flexible financing solutions powered by selected financial institutions exclusively to its partners and end customers.

The launch in Singapore is on May 6 and in Australia on May 16. The launch for India will be announced in the future.

Through its partnership with selected financial institutions, Tech Data Capital simplifies the financing process where a payment solution can be integrated into a product sale and be funded for the full term upfront.

This eliminates credit risk for the partner and provides increased customer value. Partners will

also gain access to dedicated financial teams with expertise, comprehensive training, and integrated selling alongside product marketing and sales teams.

Partners will be able to offer financing options such as instalment payments and deferred payments, with terms ranging from 12 to 60 months.

Zen Mobility inaugurates manufacturing plant in Gurgaon

Zen Mobility, an electric vehicle OEM, has inaugurated a manufacturing plant in Manesar, Gurgaon, dedicated to the production and assembling of the Zen Micro Pods, the company’s flagship electric vehicles tailored for urban commuters.

Situated on a 2.5-acre campus, the facility has a capacity of 50,000 units per year. It features comprehensive testing capabilities, including roller testing and dyno testing, ensuring quality and safety standards for all Zen Mobility products.

Beyond manufacturing, the plant houses advanced research and development facilities for design engineering and product planning.

The new facility can offer in-house customisation for innovative cargo box solutions, catering to a diverse array of applications like e-commerce, grocery delivery, food distribution, FMCG logistics, third-party logistics, cold chain management, dairy product delivery, and pharmaceutical logistics.

<figure class="image embed" contenteditable="false" data-id="543999" data-url="https://images.yourstory.com/cs/2/d99b1110116911ed9e63f54395117598/ZenMobilityManufacturingFacilityImage1-1714980975678.jpg" data-alt="Zen Mobility manufacturing plant" data-caption="

Zen Mobility manufacturing plant. Image credit: Zen Mobility.

” align=”center”> Zen Mobility manufacturing plant. Image credit: Zen Mobility.

BlackSoil invests $49M in 11 new deals in Q4FY24

Alternative credit platform BlackSoil deployed $49 million (Rs 391 crore) across 11 new deals and exited four portfolio companies in the fourth quarter of the financial year 2023-24 (Q4FY24).

In Q4FY24, fintech accounted for 37% of its total investments, followed by SaaS, deeptech, and IoT at 18%.

During this period, BlackSoil made investments in fintech companies such as Rupeek, Werize and OTO. It also exited from firms such as Freight Tiger, Homeville Group and Koye Pharmaceuticals, where it made debt investments.

In FY24, BlackSoil witnessed a 40% rise in disbursement, totalling over $118 million. It exited 18 deals while simultaneously making strategic investments in 36 new deals. 30 of its investees raised a consolidated capital of $680 million.

The Company said its year-on-year disbursement grew by 110%, and its assets under management (AUM) increased by nearly 50% year-on-year.

(This copy will be updated with the latest news throughout the day.)

Edited by Affirunisa Kankudti