U.K. challenger stockbroker Freetrade has raised a $69 million Series B round led by Left Lane Capital. The growth fund of L Catterton and existing investor Draper Esprit also participated. Freetrade operates a stock trading app and has managed to attract 600,000 users in the U.K. — they generated £1 billion in quarterly trade volume.

Freetrade has reached a post-money valuation of $366 million following today’s funding round. In December 2020, the company generated $1.4 million in revenue.

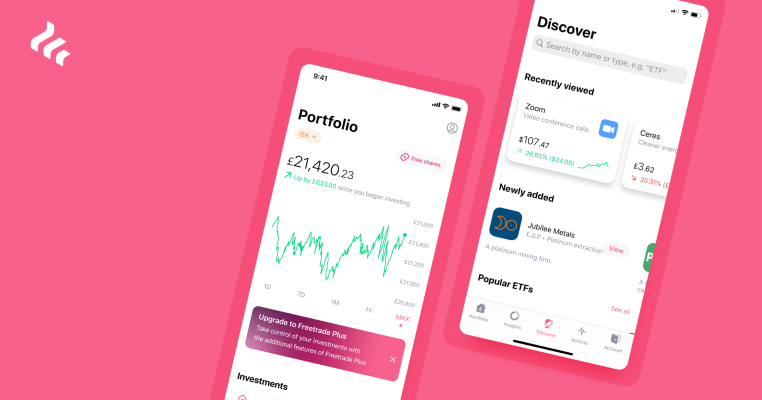

After signing up, Freetrade lets you buy and sell shares from the company’s mobile app. If you want to invest in companies with expensive shares, such as Alphabet (Google’s parent company), you can buy fractional shares. Instead of spending over $2,000 for a single share, you can buy one-tenth of a share for one-tenth of the price.

Freetrade lets you access U.S. and U.K. stocks as well as ETFs. Like Robinhood in the U.S., the company doesn’t charge any trading commission for basic orders — there’s a 0.45% foreign exchange fee on transactions in foreign currencies. Unlike Robinhood, the company doesn’t want to push you toward day trading.

In addition to free general investment accounts, Freetrade offers individual savings accounts (ISA). It’s a type of account specific to the U.K. that encourages long-term investments as tax on capital gains goes down over time. Freetrade charges £3 per month to open an ISA.

The company also offers pension savings accounts (SIPP). You get tax relief on contributions. If you live in the U.K., you’re probably familiar with SIPP. Those accounts cost £9.99 per month.

Finally, Freetrade has a premium plan for its most engaged users. You can pay £9.99 for Freetrade Plus. After that, you get 3% interest on cash up to £4,000, more stocks and more order types (limit and stop loss orders). You also get a free ISA and a discount on your SIPP.

As you can see, Freetrade is betting heavily on subscription revenue combined with a freemium approach. People who just want to buy a few shares probably stick with free accounts. But people who want to convert part of their savings into stocks and ETFs will likely end up subscribing to a tax-efficient account or a Freetrade Plus subscription.

With today’s funding round, the company plans to expand its product beyond its home country. You can expect some European expansion moves in the future.

For instance, Freetrade plans to launch in France with 5,000 stocks and ETFs from major European, U.K. and U.S. exchanges. Freetrade will support PEA, France’s equivalent of ISA, for €3 per month. And users will be able to subscribe to Freetrade Plus for €9.99 per month.

In other words, it’s going to be a very similar product in France and in the U.K. While there’s no dominant stock trading app in France, German startup Trade Republic recently launched its app on the French market. It’s going to be interesting to see how these two startups grow outside of their home countries.

![Read more about the article [Funding alert] Droom raises growth round ahead of IPO, enters unicorn club](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/Imagepgbw-1582693669294-300x150.jpg)