As the direct-to-consumer (D2C) segment continues to thrive amid the pandemic gloom, another interesting development has come up in the form of the enabler ecosystem. In simple terms, these companies/platforms offer products and services to help new-age, digital-first D2C brands across crucial business operations, be it setting up a digital interface or tech infrastructure, data analytics, marketing, customer acquisition or logistics management. Apart from helping brands scale up faster, the enablers also lower the entry barriers for aspiring entrepreneurs.

“We live in interesting times. Anyone with a great concept and a good product can launch a brand today and compete with major players in the market. The entry barrier is as low as possible, and with a continuous inflow of new consumers, the opportunities are high,” said Bimal Kartheek Rebba, cofounder and COO of Trell, a Bengaluru-based social commerce platform.

Speaking at the 2nd edition of The D2C Summit hosted by Inc42 on Dec 3 and 4, 2021, he delved deeper into the ground realities, detailing how low entry barriers and a robust enabler ecosystem encourage entrepreneurs to take the plunge, leading to rising competition in the D2C arena. Currently, the segment serves more than 100 Mn online shoppers, but this number is expected to grow exponentially as D2C brands focus on expanding to buoyant Tier 2 and Tier 3 markets. However, customer acquisition has become critically important to succeed in this space.

Understandably, the challenge is not limited to acquiring new leads or onboarding new shoppers. Customer acquisition costs (CAC) should be low enough, and the retention period should be long enough if businesses have to achieve consistent revenue growth. Rebba offered an interesting solution, though. Social commerce could be a cutting edge tool to ensure growth in a fiercely competitive market.

In simple terms, social commerce is all about leveraging social media platforms to promote a company’s products and services. The promotional formats vary widely, from blogs, audio and video content to live commerce where celebrities and influencers demo products via live streaming and purchases are made in an environment that closely mimics peer-guided, in-shop experience.

Running Trell since 2016, Rebba has unravelled how the model works. During his masterclass titled How D2C Brands Can Grow 10X With Social Commerce, he shared his insights, highlighting how social commerce could help brands with easy customer acquisition and build effective conversion and retention strategies.

Who Stands Where: The Three Cohorts Of The Domestic Market

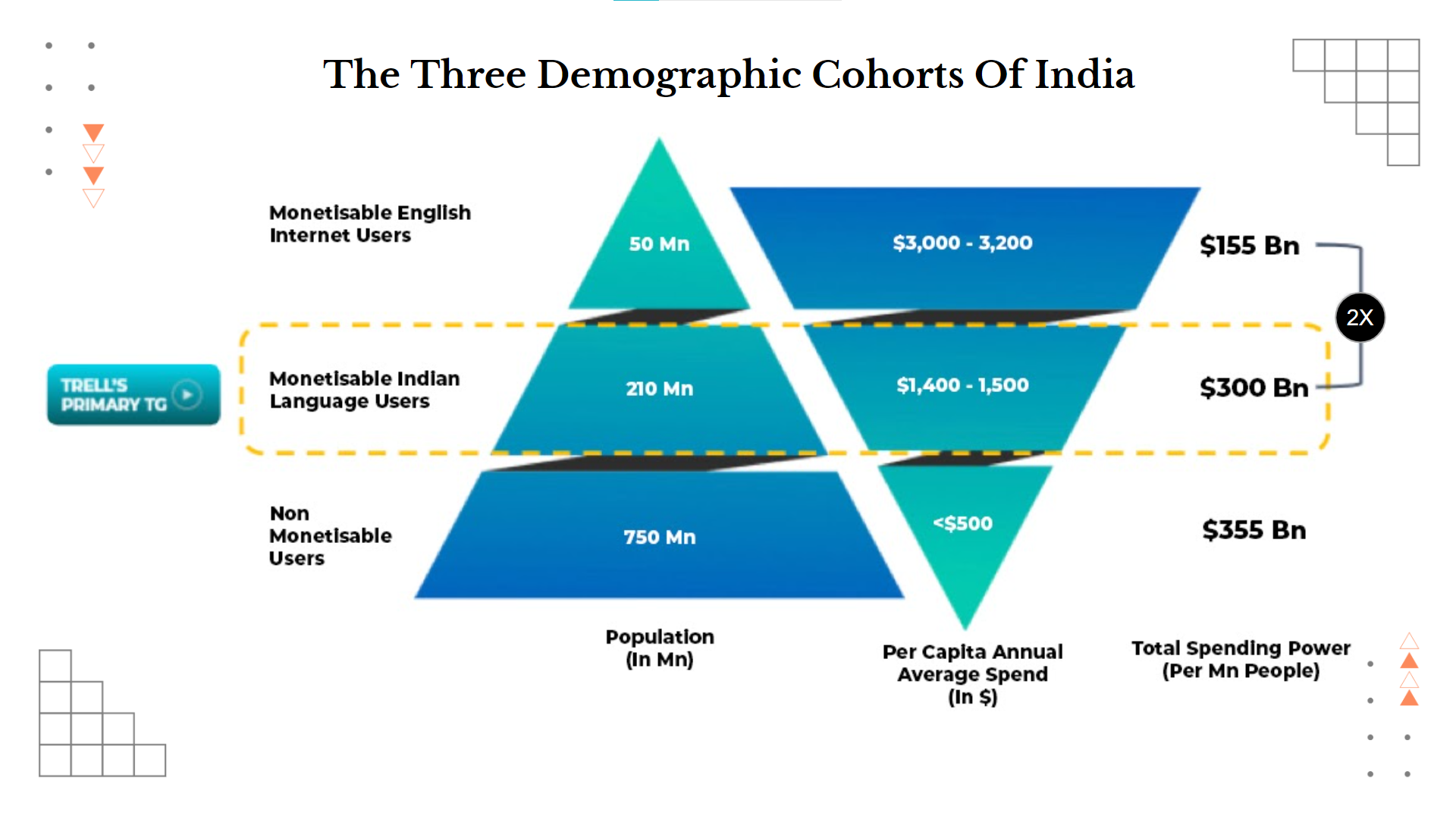

Rebba started his session by defining the three distinct demographic groups present in the Indian market. He referred to these as India 1, 2 and 3 for easy comprehension and explained their characteristics.

The India 1 cohort includes consumers from Tier 1 cities. These people are adept at online shopping on mainstream ecommerce and dedicated D2C platforms. Commanding a total spending power of $155 Bn, they generally consume English content.

In contrast, the India 2 cohort hails from Tier 2 and Tier 3 cities. They are not very well-versed in online shopping, but they make occasional purchases on popular channels, mostly led by peer influence. Interestingly, an estimated 210 Mn people from this cohort use the internet, and their total spending power is 2x of India 1. According to Rebba, this group has an inclination for consuming regional content.

Finally, there is India 3, the rural and semi-rural population that does not transact online.

“Most D2C brands are falling in the trap of appealing to the same cohort (India 1),” said Rebba.

As more brands emerge and markets grow hypercompetitive, focussing on India 1 alone will increase CAC significantly. Moreover, people within this cohort are already monetised and prefer some brand or other. So, converting them would take more effort and resources, he added.

Rebba had a solution, though. According to him, any brand that aims to acquire customers faster and cheaper should focus on India 2. However, this cohort comes with its challenges and consumer mindsets. So, brands must understand those to market to them efficiently.

Tier 2 And Tier 3 Cities: The Challenges They Pose

Online shoppers from these locations are often considered impulsive buyers. But Rebba thought it was a superficial assessment, and the actual pain points occurred at different levels. Sharing his insights derived from the Trell platform — more than 60% of its user base comes from these regions — he underlined the following four factors that made customer acquisition a challenging task for brands focussing on this cohort.

Lack of awareness: These consumers do not have enough knowledge about the products or the brands that may offer the best possible solutions. Also, brands mostly communicate in English and put written descriptions on product pages, thus creating a communication gap.

Lack of trust: Most of these people prefer not to transact on D2C platforms. Although Amazon and Flipkart remain the most popular channels for online shopping, doubts about the quality of products and uncertainties regarding delivery make this cohort reject independent brands.

Need for social validation: Consumers in these regions tend to make purchases based on peer recommendations. This is more evident in the fashion, beauty and personal care segments and home decor and home appliances space that include a wide variety of products.

Price sensitiveness: Shoppers from these locations prefer to purchase low-to-mid-priced products instead of premium ranges. Due to lower spending power and the lack of trust in online brands, they choose to make their large-ticket purchases offline.

To acquire digital shoppers from Tier 2 and Tier 3 markets, it is crucial to develop a marketing strategy that will address these concerns and more.

Rebba thought social commerce could play a significant role in bringing these consumers to the conversion funnel. “Essentially, trust is the key to overcoming the concerns a consumer (from these regions) may have. But social commerce can leverage regular users with social influence as product promoters to build trust in a brand,” he said.

How To Use Social Commerce To Increase Reach

The Trell founder suggested that vernacular video-based social media has the highest potential to drive brand growth through customer acquisition.

“According to our research, 325 Mn online users watch video content online for two-three hours on an average day. Among them, 73% consume video content in vernacular languages. The audience on those video platforms are primed for social commerce,” said Rebba.

Brands must look out for these four levers while building a social commerce platform on their own or partnering with a third-party platform.

Simplified order placement: An essential feature of social commerce is building an engaging shopping experience. Ideally, such a platform should allow a user to select the product, add a delivery address and make payment from the platform itself. If a customer has to leave the platform to complete a purchase, it may result in higher cart abandonment as it involves too many steps.

Engaging social experience: The social element is an essential part of experience building for users. A platform without new content and regular updates cannot boost footfall to make social commerce viable. Citing Trell, Rebba said that due to its easy-to-consume short video format, the platform witnesses more than 60 Mn monthly active users who spend an average of 40 min a day on the platform.

Awareness drive: Social commerce also provides a unique opportunity to generate better product awareness in an interactive manner. In fact, brands should not be limited by content format or language barriers. For instance, Trell’s short video format allows micro-influencers to develop creative videos in regional languages to help users gain better product clarity.

Peer validation: Finally, social commerce helps create personalised product promotion as users are more likely to buy the recommendation of someone similar to them. For instance, a consumer will be more willing to buy a T-shirt suggested by someone with a similar body type.

Apart from these benefits around conversion and retention, a brand also gets the opportunity to improve its visibility and reduce customer acquisition costs by just being present on the platform frequented by customers.

To highlight the impact of social commerce, Rebba shared the case study of Bombay Shaving Company. After running a 14-day promotional campaign for its DeTan kit on Trell, the men’s grooming startup clocked 9 Mn video views, more than 2.5% of the clickthrough rate and a 5x spike in product page views. (Clickthrough rate, or CTR, measures an ad’s success in grabbing viewers’ attention.)

“Social commerce is not just a concept. It is the way users are going to shop in the future. Today, 7% of the entire ecommerce GMV comes from social commerce platforms, and by 2025, it will reach 15-20%. It also gives brands a unique opportunity to tell their stories through regular users and build a sizeable and loyal customer base,” concluded Rebba.

The post Tapping Beyond Tier 1: Four Pain Points That Deter D2C Growth And How Social Commerce Can Fix Them appeared first on Inc42 Media.