Startup investors and founders are facing a myriad of challenges today. From navigating through macroeconomic conditions to ensuring business growth, this is the age of multi-taskers. However, chief financial officers (CFO) have to overcome another obstacle—keeping corporate governance in check.

Recent examples of GoMechanic, Trell, and Zilingo have highlighted the pressing need for good corporate governance and diligent financial management.

In this light, the role of a CFO has become important, now more than ever. It has evolved into much more than just keeping financial records. They need to be advisors, strategists, and motivators for the entire organisation.

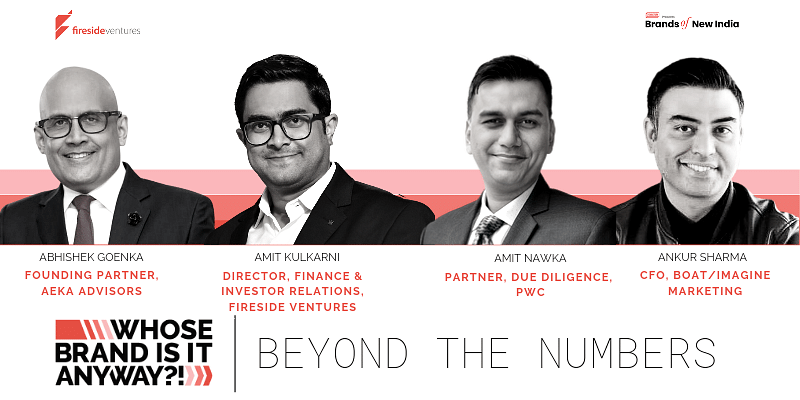

In the final episode of ‘Whose Brand is it Anyway?’—a series led by YourStory’s Brands of New India in collaboration with Fireside Ventures—Amit Nawka (Partner – Due Diligence, PwC), Abhishek Goenka (Founding Partner, Aeka Advisors), and Ankur Sharma (CFO, boAt) talk about what makes a good CFO and why they must learn to adapt to changing organisational needs.

The series aims to create a platform where budding entrepreneurs can learn the inside out of building businesses from those who have been able to create successful brands.

Bengaluru-based is an early-stage investment platform for consumer brands. Anchored by a slew of marquee investors, including Premji Invest, Westbridge Capital, Mariwala Family Office, Unilever Ventures, Emami, RP-Sanjiv Goenka Family Office, Sunil Munjal’s Hero Enterprise Investment Office, and ITC, Fireside invests in consumer brand startups in multiple rounds—from seed to Series A funding.

Founded in 2017, Fireside is also building a first-of-its-kind ecosystem for entrepreneurs in this space, with a strategic support network of in-house and partner resources.

“CFO also stands for Chief Fix-It Officer,” Abhishek Goenka of Aeka Advisors, says, adding that good CFOs must possess the ability to multitask varying functions—from human resources and admin work to legal and creative matters.

Amit Nawka, Partner (Due Diligence) at PwC, believes that independence, reliability, and the ability to innovate also make for crucial qualities in a good CFO.

“It is very important for CFOs to use advisors in the right way. Don’t use advisors to cover your back but use them to prop you forward. Many times, we will see somebody who will simply file a report without incorporating suggestions from an advisor. So use advisors constructively,” says Ankur Sharma, CFO of boAt.

He adds that seasoned financial executives must also do away with the notion that finance as a profession is an endless task, which will require one to work tirelessly all day. “The change in mindset will make a world of difference.”

PwC’s Nawka says a nuanced understanding of metrics is pivotal. He adds that as the business expands, various aspects like marketing, customer acquisition, and the total addressable market comes into the picture. A good CFO must always be ready to learn.

CFOs must also be malleable, an important function when the company starts to grow. Young startups that come to the fore with a small team spearheaded by a founder often ignore the idea of monitoring finances, eventually leading to grave misreporting.

“Many young firms report finances on a spreadsheet and use basic accounting software. Ideally, as the company scales up, it should maintain a common database of numbers for internal and external stakeholders. Gradually, an accounting team must be formed for effective and accurate decision making,” says boAt’s Sharma.

The episode ends with the team discussing how CEOs and CFOs must work in a collaborative fashion.

Tune into this session to hear insights from the most sought-after financial executives and advisors in the country.