UPI recorded 558 Cr transactions in April 2022 as opposed to 540 Cr transactions in February 2022 – recording a month-on-month (MoM) growth of 3%

In May 2022, the transaction volume grew by 5.9% while the transaction count increased by 6.6% MoM

After a steep decline in growth between February and April 2022, UPI has picked up pace in May 2022 despite an impending global recession

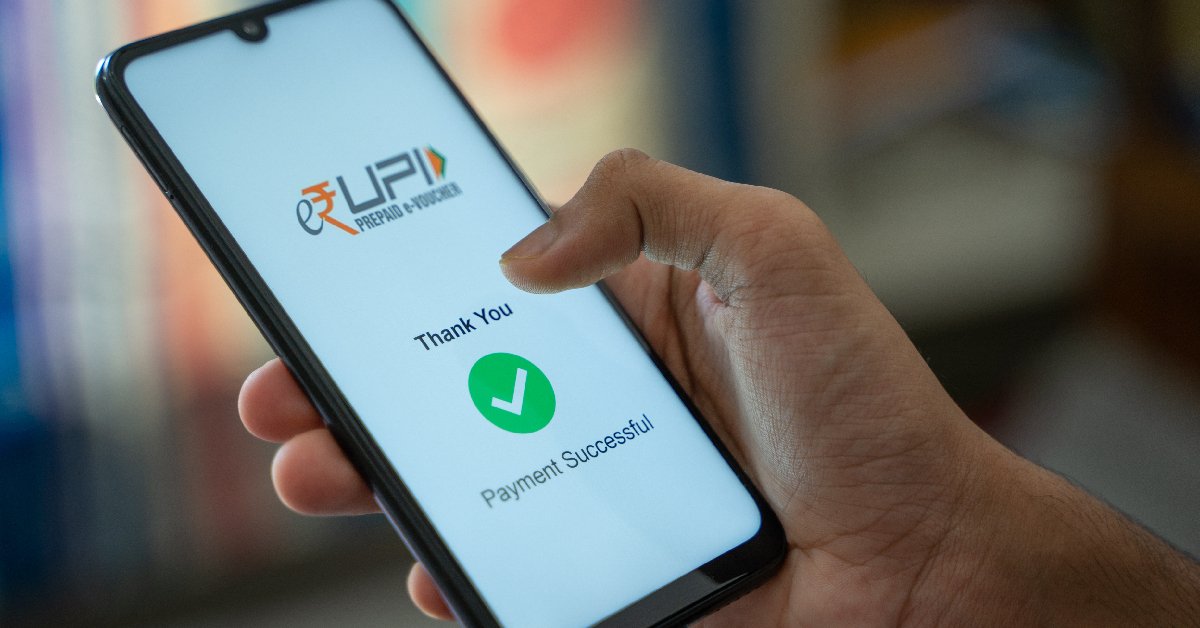

The month of May 2022 has been largely marred by the stories of layoff, funding winter, economic slowdown and an impending global recession. One segment that remains by far unaffected (at least in numbers), is the UPI ecosystem of India. In May 2022 alone, UPI recorded 595 Cr transactions worth INR 10.4 Lakh Cr.

The payment processing tech platform grew by almost 6% month-on-month (MoM) from April 2022 when it registered 558 Cr transactions. The transaction volume also increased by 6.6% from INR 9.8 Lakh Cr to INR 10.4 Lakh Cr ($134.3 Bn).

While the growth has declined to single digits in the last two months, UPI has already crossed almost 80% of the transaction volume of 2021 in five months of 2022.

Compared to May 2021 when UPI transactions were at a mere INR 4.7 Lakh Cr, the transaction volume of payments happening over UPI has grown by 122%.

UPI is currently the most popular digital payment system in India. It has 323 banks linked to it. While the numbers for May 2022 are not out yet. In April 2022, the State Bank of India (SBI) was leading the segment by processing about 154 Cr transactions.

It was followed by HDFC Bank with 49.7 Cr transactions, Bank Of Baroda with 36 Cr, Union Bank with 34.6 Cr, ICICI Bank with 32.5 Cr and Paytm Payments Bank with 31.6 Cr transactions.

UPI Lite, UPI123Pay & Cross Border Remittance To Emerge Ecosystem Turners?

UPI apps such as PhonePe, Google Pay, Paytm and now even WhatsApp Pay have been ruling the online payment industry. However, NPCI believes that small payments (<INR 200) consume a lot of system capacity, tech bandwidth and bank resources. It is noteworthy that in April 2022, over 70% of the UPI transactions were done of value under INR 500.

The NPCI intends to change the modus operandi of small value transactions through UPI by taking it offline with the feature named ‘UPI Lite – On-device wallet’.

Through the ‘on-device’ wallet in the UPI app, RBI proposed to increase the adoption and boost the success rate of low-value UPI transactions. Consumers can ‘recharge/replenish’ when they are online and the upper limit of the wallet will be INR 2,000, to ensure the security of the user’s money.

On the other hand, UPI123Pay is also aimed at resolving the issue of an off-internet payment facility on feature phones. It is unclear how many transactions have happened via feature phones and the USSD (*99#) payments system since they are a part of the total BHIM numbers. But since the launch of feature phones in March 2022, the total transactions via BHIM for March and April 2022 have been INR 16,405 Cr, rising by over 10% MoM.

Alongside new features to include every type of digital payer in India, UPI is also looking to expand internationally. While it has already tied up with several institutions in Nepal, the UAE, Japan and China, RBI has outlined the NPCI will be working on establishing the digital payment service as a channel for making cross-border remittances.

The apex bank, in its annual report for FY22, claimed that similar to linking Singapore’s PayNow and UPI, to enable instant fund transfers (remittances) without the need to get onboarded onto the other system, NPCI will be looking to partner with other international systems as well.