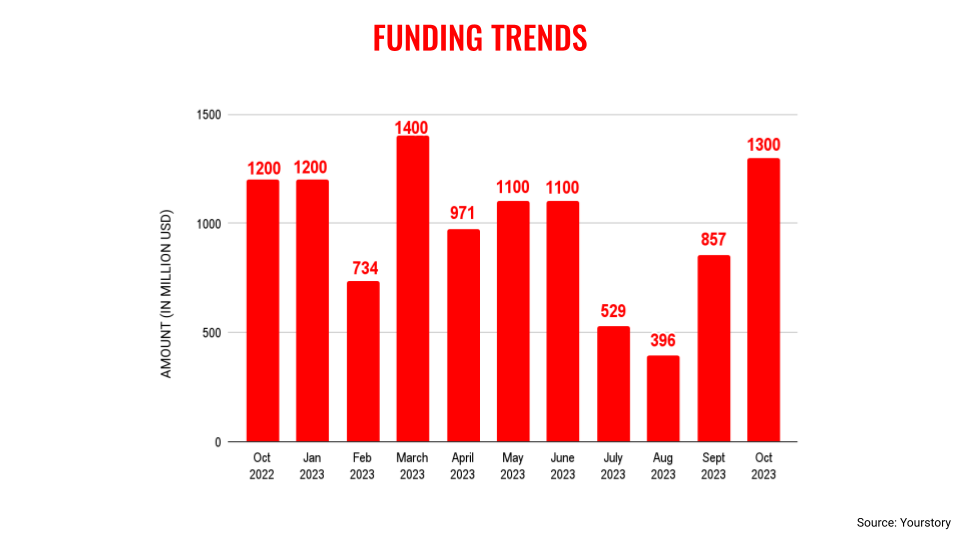

The month of October has turned out very positive for the Indian startup ecosystem as venture capital (VC) funding saw a yearly increase and an even sharper rise on a month-on-month basis, boosted largely through debt transactions.

The month saw total VC funding of $1.3 billion cutting across 107 deals—which was a 5.2% year-on-year rise from October 2022 which saw a total VC inflow of $1.2 billion, according to YourStory Research.

On a month-on-month basis, the increase in VC funding is 45%. It is also the fifth time this year that monthly VC funding has crossed the psychologically important mark of $1 billion.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

This sharp rise in venture funding is also a surprising development considering that the last three months of the year actually witnessed slowness in funding activity.

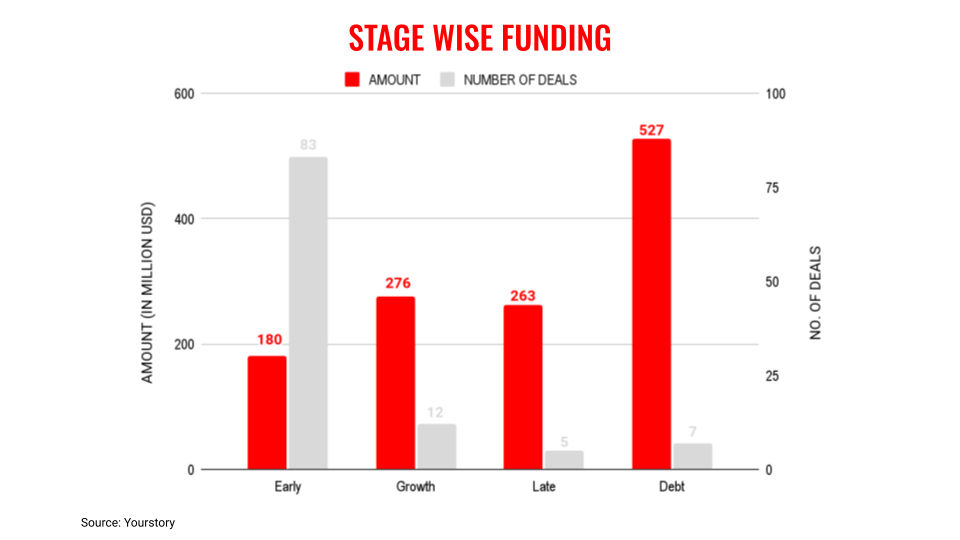

The boost came from the debt category which amounted to $527 million on the back of big-ticket transactions of Ola Electric and Zolve. This is also an indication of the present environment where startups have to resort to the debt route to raise capital as there are still considerable challenges for large amounts of money coming through the equity channel.

The key trend this year shows that the early-stage category of funding continues to see the highest activity in terms of the number of deals but the value of capital remains low. For example, in October, the early-stage category saw 83 transactions but the total value stood at just $180 million.

It is unlikely that large amounts of venture funding through the equity route will open up anytime given the macroeconomic conditions of global political tensions and turbulent stock markets. Added to this, there are the high interest rates which will make investors park their money into safer instruments like gold and government securities.

Despite this, there were some interesting transactions during the month from the likes of Mensa Brands, InsuranceDekho, and Skyroot Aerospace to name a few. They have raised money in the range of $25-60 million with backing from their existing investors.

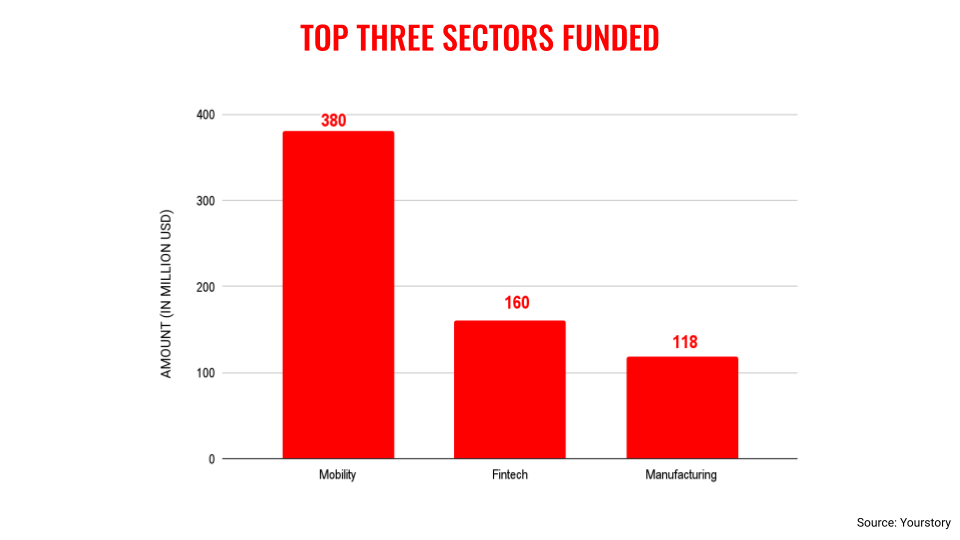

The top three sectors in terms of raising VC were mobility, fintech and manufacturing. The mobility segment, especially the electric vehicle category, continues to gain traction among investors.

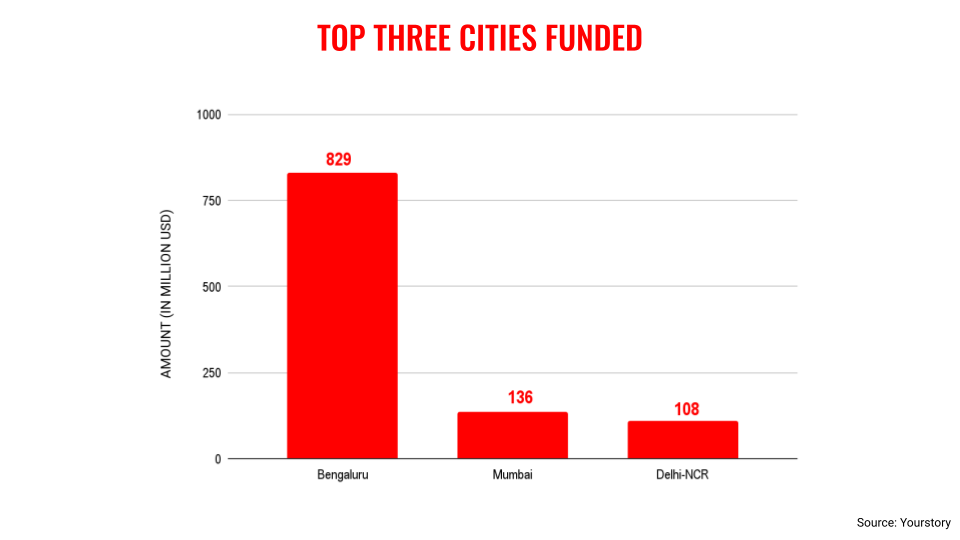

In terms of the top three cities that raised venture capital in October, there was no change in the pecking order of Bengaluru, Delhi-NCR, and Mumbai.

The only hope now is that the current trend of VC fundraise continues for the remaining two months of the year but this could be an over-optimistic expectation. There is still a strong element of caution among the VCs to invest in startups as one is not sure how the overall economic environment is going to turn out.

The recent developments in the US also reveal that VC firms are finding it difficult to raise capital largely due to the high-interest rates in the country. This could have a trickling-down effect on the Indian startup ecosystem.

Edited by Kanishk Singh