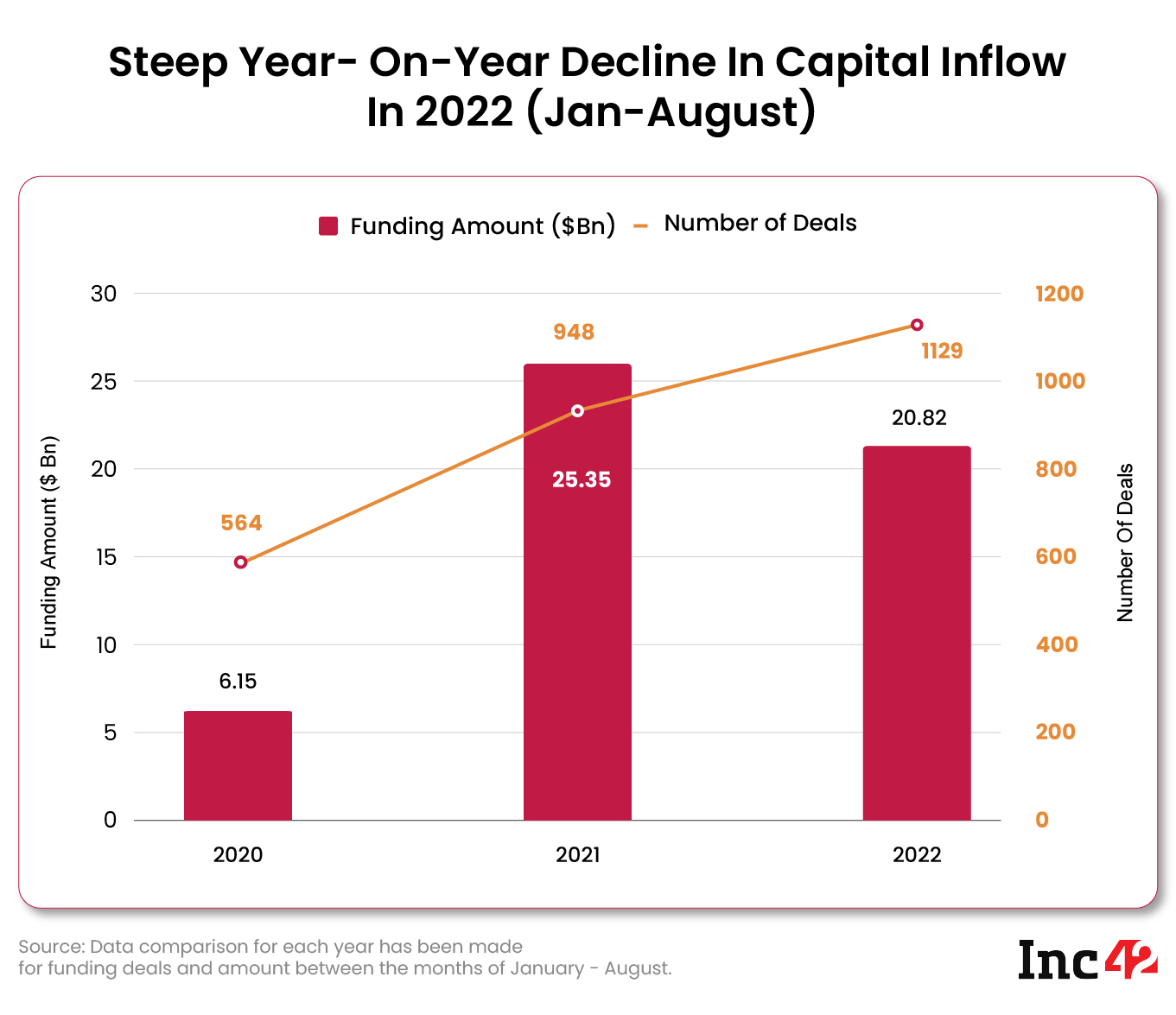

Indian startups raised $20.82 Bn in funding in the first eight months of 2022, down 17% from $25.3 Bn raised in the same period in the previous year

However, deal count during the first eight months of 2022 surged to 1,129, up over 19% from 948 during the same period last year

The ongoing war in Europe and rising inflation have made investors wary, and this has translated to an increase in small-ticket fundraises in 2022

The purported ‘funding winter’ continues to hit the fundraising plans of the Indian startups. According to Inc42 data, the capital inflow into the Indian startup ecosystem plunged 17% to $20.82 Bn during January-August period of 2022 as compared to the corresponding eight-month period of 2021.

Indian startups had raised a record $25.35 Bn in venture capital funding during January-August 2021 period.

The only silver lining for the Indian startup ecosystem in August 2022 was logistics startup Shiprocket turning unicorn after raising a $33.5 Mn Series E2 funding round led by Lightrock India.

Apart from that, August also witnessed three mega deals of over $100 Mn. While upGrad raised a round of $210 Mn, EarlySalary bagged $110 Mn. CleverTap picked up $105 Mn in funding last month.

Besides, insurtech startup Digit Insurance filed its draft red herring prospectus (DRHP) with market regulators SEBI for initial public offering (IPO). According to media reports, the Bengaluru-based unicorn plans to raise INR 5,000 Cr through the IPO.

Interestingly, the deal count surged 19% to 1,129 during January-August 2022 from 948 during the first eight months of 2021.

The increase in deal count along with the decrease in funding amount can be attributed to an increasing number of small-ticket fundraises in 2022.

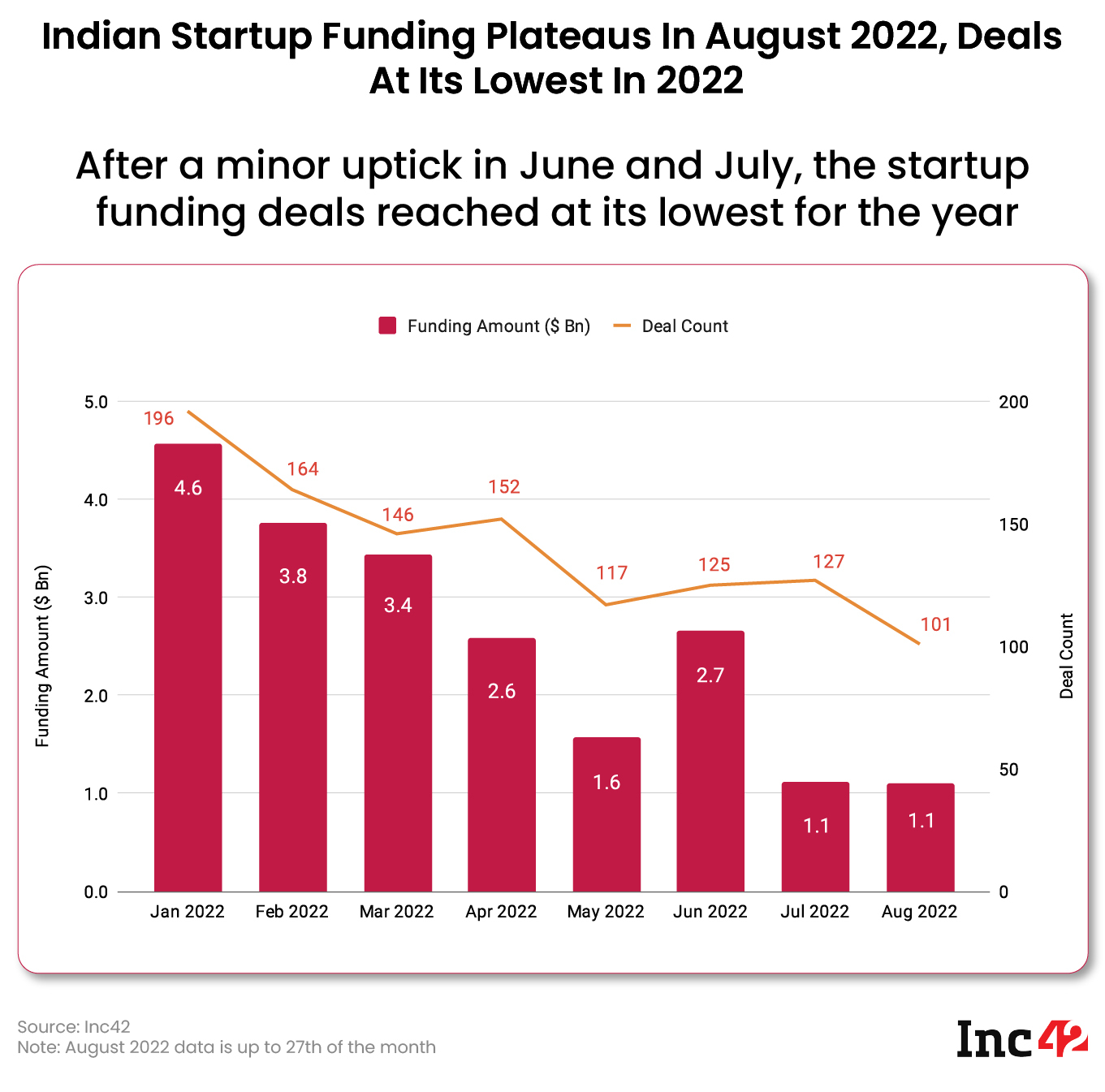

The year 2022 began on a strong note, with Indian startups raising $4.6 Bn across 196 deals in January. However, the funding slumped 76% in August as compared to January, while the deal count also fell 48% to 101 deals.

Overall, the downward spiral continued in the Indian startup ecosystem in August. According to Inc42 data, July 2022 recorded the worst funding number of $1.1 Bn across 127 deals in 17 months. The trend continued in August, with startup funding failing to keep pace with last year’s record numbers and recording a similar funding amount as July. To make matters worse, the deal count also declined.

What Is Behind The Slump?

The plummeting funding numbers have largely been attributed to tightening monetary policies around the globe due to high inflation and the ongoing geopolitical tensions between Russia and US over the former’s invasion of Ukraine. The fears of a recession have also made investors wary.

“Macro conditions have been fluctuating globally, which has made investors more cautious. However, the impact of these fluctuations is felt less by startups at seed stage,” Merak Ventures’ Sheetal Bahl told Inc42.

A breakdown of the data for the month of August 2022 revealed that even seed-stage funding was hit. Seed funding fell to $46 Mn in August 2022, down nearly 69% from $148 Mn in July this year. On a yearly basis, seed funding tanked 57% in August 2022, while deal count fell 19% during the same period.

“There has been rationalisation when it comes to funding across sectors in 2022, a correction which was perhaps a little overdue. Capital is available for problem solvers, who are passionate coupled with sound business fundamentals,” said BlackSoil director and cofounder, Ankur Bansal.

The slight slump seen in July and August funding is part of a recurring theme seen this year. The strong numbers in the first two months of the year were followed by a brief lull in March and April numbers. The funding again picked up in May and June before plunging in the last two months.

However, investors continue to be bullish about early-stage startups amidst the continued downturn.

An early stage investor recently told Inc42 that a lot of seed rounds this year would be ‘option bets’ by long-tail investors who have the corpus for low-exposure spreads, but might not want to take large risky bets that can backfire in this volatile market.

Last month, Merak Ventures launched its maiden $100 Mn VC fund targeted at early-stage startups. Prior to that, Weave Capital also launched a multi-stage VC fund of $75 Mn to invest in early and growth-stage startups

In July, LetsVenture cofounder Shanti Mohan launched an INR 50 Cr micro VC fund Propell to invest in 30 early-stage tech startups. Fundamental VC launched its maiden fund with a target corpus of $130 Mn in June to invest in early-stage startups across multiple verticals.

“This is on account of early-stage VCs, angel funds, and incubators being bullish on backing early-stage startups where the focus continues to be on scaling the business and finding the right product-market fit,” noted Bansal.

Funding Winter Leads to Valuation Cuts and Layoffs

The ongoing market volatility has spooked investors who are wary of investing, bringing an abrupt end to the funding boom of 2021. Scarcity of funds has even forced many startups, from unicorns to soonicorns, to re-evaluate their business and cut corners. As a result, many have shelved expansion plans and laid off employees in droves.

According to Inc42’s layoff tracker, Indian startups have so far laid off more than 12,000+ employees in 2022. This week, Tiger Global-backed Koo fired 40 employees, while healthtech startup Innovaccer laid off 120 employees.

Besides, high inflation has forced many users and clients of these startups to save funds and cut down on unnecessary expenditure. As a result, many startups are seeing decline in revenues, while others are embracing the consolidation wave to tide over the ongoing funding chill.

The funding crunch has hit so hard that many startups have even taken a valuation cut. In July, it was reported that epharmacy PharmEasy was in talks with investors to raise $200 Mn at a 15-25% lower valuation than the last reported $5.1 Bn. Later, the company shelved its IPO plans and withdrew its DRHP.

Oyo is also reported to have been mulling reducing its IPO size to $800 Mn from the previous $1.2 Bn planned earlier. Inc42 has also reported that the hospitality unicorn now plans to list on the bourses around Diwali owing to choppy market conditions.

Speaking during an earnings call earlier this month, SoftBank’s Masayoshi Son also warned that the ongoing funding winter would last longer for unicorn founders that are unwilling to accept a lower valuation to raise funds.

Even as the market continues to be in a flux, the sentiment is expected to remain bearish for some time. Many VCs have pointed out that the worst of the funding winter will be over in the next 3-4 quarters, adding that full recovery to pre-2022 levels might take till the end of 2023.