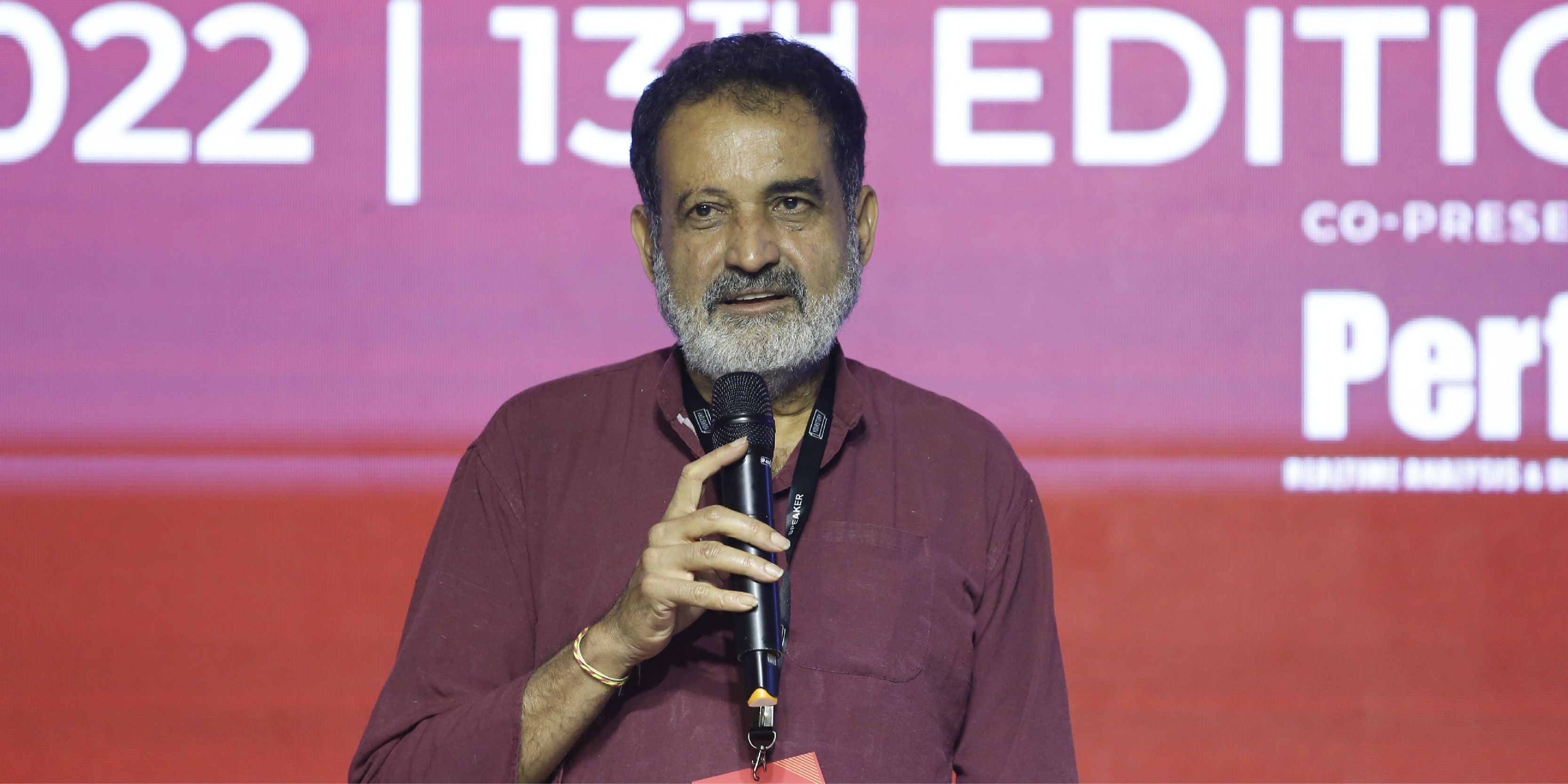

Industry veteran T V Mohandas Pai is ever the optimist when it comes to the Indian startup ecosystem.

Despite the challenges of funding, layoffs, and governance issues, Pai believes startups in the country will play a pivotal role in the economy going forward, riding on the wave of the digital revolution.

Recently, the co-founder of VC firms Aarin Capital and Exfinity Ventures was inducted into the advisory council of BYJU’s, as the edtech firm seeks to find its way through an arduous phase. He is also on the boards of several institutes spanning the sectors of education and healthcare and companies such as Havells.

In a candid interview with YourStory, Pai spoke about several issues pertaining to the Indian startup ecosystem and how startups can navigate challenges, move forward, and grow with confidence.

“We should not be disheartened by the so-called funding winter which is very exaggerated. These are normal cycles which happen, which have happened, and will happen again,” he says.

The straight-talking Pai also advises founders and first-time entrepreneurs to be frugal and respect capital as it is not free.

Edited excerpts from the interview.

YourStory (YS): How do you view the current environment in the Indian startup ecosystem?

Mohandas Pai (Pai): The industry has grown to a tremendous size with around 100,000 registered startups and 108 unicorns, with a funding of $135 billion from 2014 till 2022 and the creation of $500 billion of value. This resulted in maybe 1.6 million to 1.7 million jobs.

In many areas of technology, large and small companies have come up with so many people becoming entrepreneurs. So, the industry has seen a lot of success.

This (the industry) has seen a lot of challenges because of the success they (startups) have had. Due to flow of capital, many people were focused on valuation rather than value creation.

In every economic cycle, value creation comes first. They (startups) need to build value creation to catch up with valuation.

There are many people who idly spent money, thinking that money is an endless pot. Realising this mistake, they are now reshaping and reworking, so they’re gearing up.

Many new companies have grown very well in the last two years and are ready for the next round of funding. So we’ll get more unicorns as soon as the funding tap opens up. I believe, by 2026, we will have maybe 200 unicorns and at least about $1.5 trillion of value and 3.5 million people employed by this industry.

I’m very positive because I see the growth every single day. We should not be disheartened by the so-called funding winter which is very exaggerated. These are normal cycles which happen, which have happened and will happen again. Life is never a one-way street.

The failures have happened because these people have never run companies before. They do not know what is governance. They don’t have proper systems. They think only of growth, growth, growth, GMV. They have spent and hired crazily.

Now there is a balance in the market. Whenever the market gets into excesses, value falls and the balance comes.

YS: Why are you so bullish about the Indian startup ecosystem?

Pai: We are in the midst of a digital revolution globally. Out of eight billion people on the planet, five-and-a-half billion people have a mobile connection, more than 5 billion people are on the internet.

Last time it happened was 250 years ago, when the industrial revolution started in Great Britain and Europe, and they dominated the world. They created a global supply chain to connect consumers to producers.

In the last 15 years, we have seen the rise of the digital revolution. This time India is at the heart of the digital revolution and is driving it.

Second is, we are the world’s largest software services exporter, running into billions of dollars, where about 5.5 million people are employed. We have a huge amount of human capital, not just in India but also globally, especially in the US. India will soon have, by 2026, more people in technology than in the United States.

One does not see the impact much in India because we are a smaller economy. You see the impact for US companies and others, where much of the global innovation is driven by people from India. We are maybe two years behind in the latest technology because we don’t have the capital or R&D.

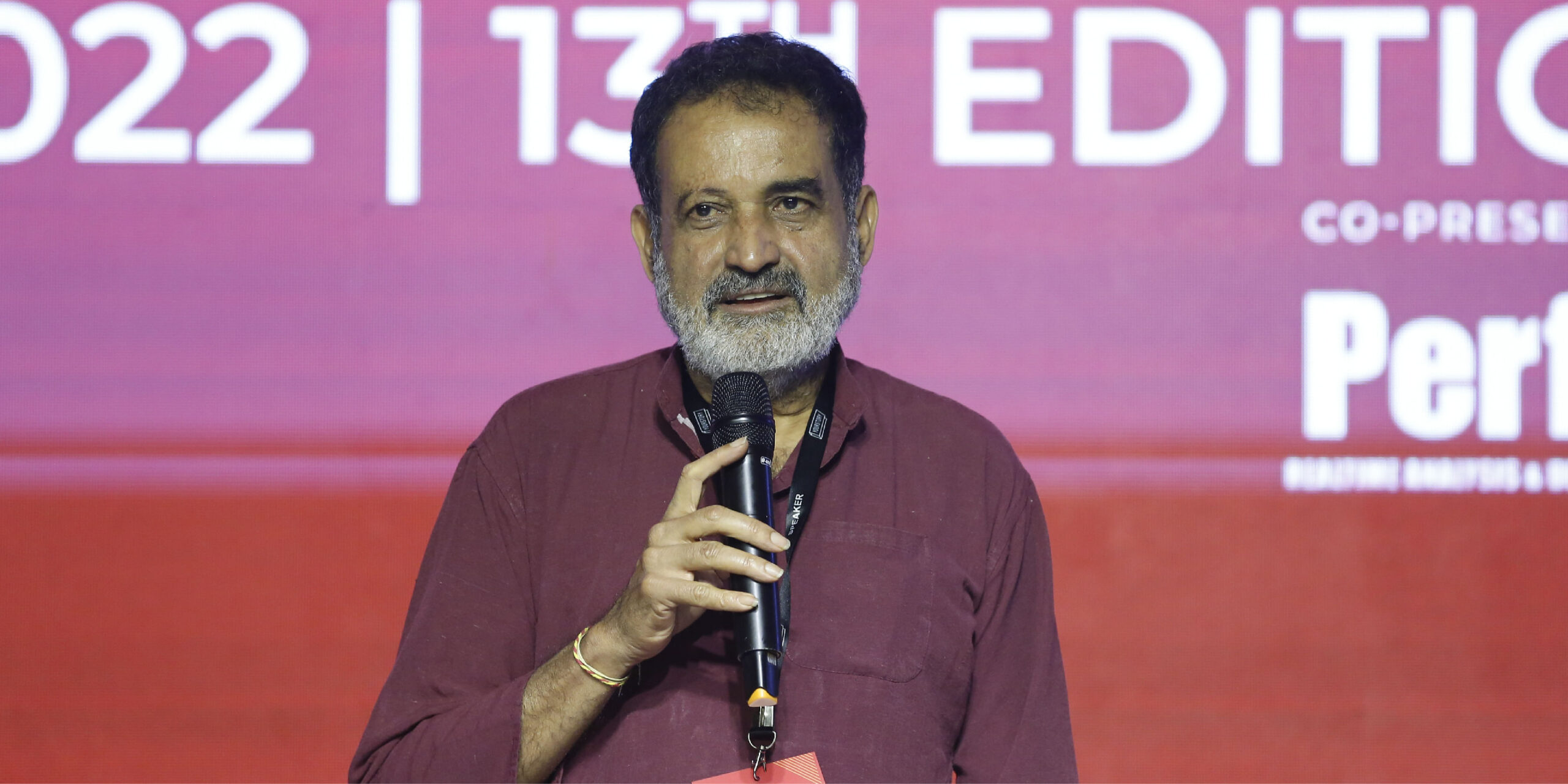

The third big strength is that India has become a digital nation with examples such as UPI, India Stack, ONDC. India has created a robust digital infrastructure to remove the distance between the consumer and the producer, where one can transfer money across India in 30 seconds.

There are billions of financial transactions happening through the digital route. This has increased the velocity of business while costs are coming down dramatically. The benefits are being seen in increased productivity.

No other country in the world has built this kind of infrastructure which is low cost. India has championed the model of the digital public good, which is unbelievable because these are basic building blocks. Indian companies can easily write on that and build to become innovative.

When the Prime Minister Narendra Modi spoke about Digital India and Startup India, nobody understood what it meant. Today, many things are permeating into areas such as industry 4.0, robotics, etc.

All this is happening in a big way but the impact will take time. India has a growing young population with all these advantages and I think we are on the right path.

YS: How can startups navigate through this funding winter?

Pai: Startups have their limitations. Many of them are first-time entrepreneurs and do not know many things; so they should have mentors or coaches who are accomplished, go to them with dilemmas, and learn from them. They must also learn on the job.

One thing they must keep in mind is that they must respect capital as it is not free. Nothing is free in life. Also, they must also not take high compensation for themselves. They are founders and have to make sacrifices, working 24/7.

They also need to be humble enough to understand and treat people well. And also be very frugal. Then they will succeed.

YS: Will India create global companies?

Pai: We have got very big companies and they will be global companies as many of them are already in the US. They will grow but will they be among the top 100 global giants? I do not know. For that, you need capital and markets.

But we will certainly have much bigger companies than earlier. Look at how Paytm has become much bigger than what they were three years ago. They are all learning and getting used to being in the public markets. The public markets are very brutal. They do not care about your ego or reputation.

The only thing the public market asks is: am I going to make money investing in you? Don’t get romantic and say I’m the greatest creation, I’m the greatest innovator. Nobody gives a damn.

And there’s a lesson these people have to learn. Now all of them have become humble. They’re responding. They’re working harder, trying to cut burn and all that.

YS: Many Indian startups seem to be clones of what’s already in the West, especially in the US. Maybe they lack innovation. What are your views on this?

Pai: You need money to fund innovation and greenfield projects. Nobody gives money in India. Everybody says they want a Microsoft or Intel kind of company from India. This is loose talk.

Where is the capital? LIC has got a balance sheet of Rs 60 lakh crore but have not invested a single penny in startups. Global pension funds from US, Canada, Singapore, Japan are investing in startups in India.

We need at least $10 billion to be spent on innovation every year, either by the Indian industry or governments. Otherwise, you cannot produce companies which are leading edge. It takes 8-10 years to show results in deep technology.

Yes, there are many companies in deep technology which are very small; we have to fund them. There are many good companies from the Indian startup world, like in the fintech segment which is the best in the world.

We don’t have to beat our chests and say there are no Microsoft kind of companies in India. Which country other than the US has a Microsoft kind of company? Does Europe or China have one? No. It happened only in the US because they are a $23-24 trillion economy with a huge market and enormous amount of risk capital with technology assimilation across the industry.

We have done a fantastic job in this area of software services and startups. We should be proud of them. What we have achieved is unprecedented for any country in the world.

Now, can we rest on our laurels? No. Let’s go to the next step. We need all these companies to grow.

Edited by Swetha Kannan

![Read more about the article [Funding alert] Online beauty training platform Vah Vah! raises seed round led by Sequoia Surge](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/photo-1594941250082-85e4c770d293-1626167494579-300x150.jpg)

![Read more about the article [Funding alert] Junio raises additional Rs 5 Cr in seed round](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/165-VC-funding1552277843560-300x150.jpg)

![Read more about the article [Funding alert] The Whole Truth raises $6M Series A round led by Sequoia Capital](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/Imageaipg-1627389759783-300x150.jpg)