The unforeseen circumstances surrounding the COVID-19 pandemic have had a profound impact on the travel industry that took a massive hit amid the unprecedented lockdowns. The restrictions on airlines and public movements are yet to fully ease up. However, more than a year into this universal health emergency, there have been some noticeable changes in the car rental industry.

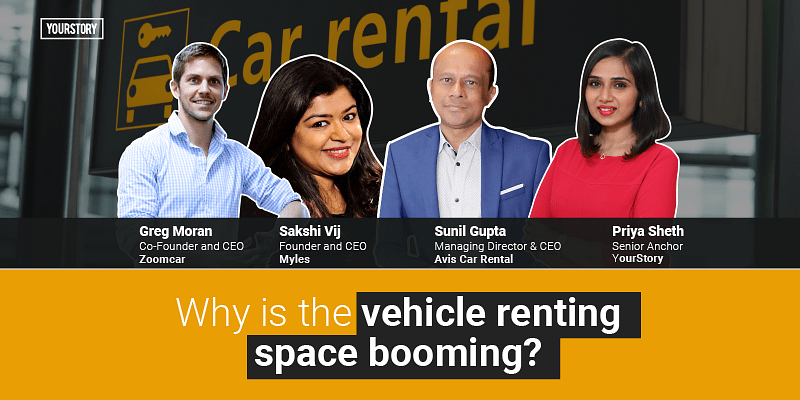

Zoomcar, a self-drive mobility startup, saw a surge in demand as the country’s unlock process began. Greg Moran, Co-founder and CEO, said that this is mainly because people want to go out after being curtailed at home, while being mindful of safety concerning COVID-19. The company said most of the demand is for leisure purposes.

A rise in demand for ‘domestic travel’ was also noted by a car rental service company, MylesCar. Since international flights were halted, people have been opting for local locations as getaway options.

“People don’t mind taking longer road trips anymore,” noticed Sakshi Vij, Founder and CEO at Myles. She adds that the demand for longer drives has increased because the whole family can travel together without worrying about excessive exposure to the virus.

With social distancing playing a big role in preventing COVID-19, the founders say that many people consider travelling by road in self-driven cars to be a safer option.

Another mobility startup, Avis India, is now looking at reaching pre-COVID-19 revenue numbers in a couple of weeks. “To compare the first wave and the second wave, in July 2021, the demand volume was four times what we saw last July. People are getting more confident about stepping out,” explains Sunil Gupta, MD and CEO at Avis India.

The ‘new normal’ also led to new avenues of demand for these companies. With the onset of the lockdowns, the customers’ priorities to seek out mobility has changed as well. According to Zoomcar, many people who wanted to go back to their native places or visit their villages also chose to rent cars.

The dynamics also changed for Myles as they realised that the healthcare and frontline workers frequently rented the vehicles. The first lockdown had laid out much stricter restrictions for public transport services, which led to car rentals becoming an alternative option for frontline workers.

Along with this change in perspective, Sunil also points out that access to vehicles has become a much more important factor than ownership. He adds that the young generation is looking at easy access to vehicles when the need arises as opposed to investing in a full-time vehicle.

In the expectation that the same trends continue, Zoomcar will be expanding its subscription models to 10 cities, with an emphasis on hyperlocalisation of their reach and car usage. They are expecting a 3-4x growth in FY2022, and have been growing their fleet of 10,000 cars to 30,000.

Subscription growth is also a big factor for Avis India as they aim to reach 30 cities and increase their fleet of cars by 30 percent towards the end of FY2022.

In the case of Myles, they are looking at building a strong base in alternative vehicle acquisition services. The company wants to own at least 1 percent of the total new and used cars market in India by FY2022.