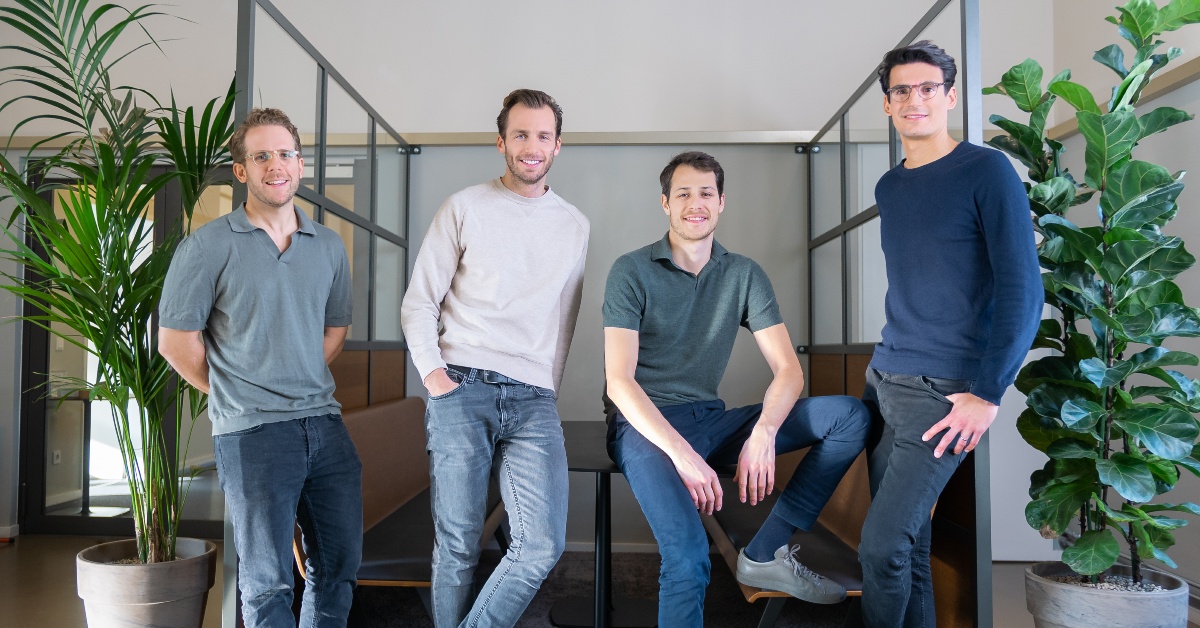

Moss founders Ferdinand Meyer, Anton Rummel, Stephan Haslebacher, and Ante Spittler | Image credit: Moss

Berlin-based Moss, a payment and credit card platform that enables companies to optimise their finances, announced on Wednesday that it has raised €75M in its Series B round of funding. The round was led by US-based venture capital firm Tiger Global Management along with A-Star.

The news comes just six months after the company raised €24.79M in a Series A extension round from Peter Thiel’s VC Valar Ventures and other investors. With the latest funding, the startup is on its way to achieve unicorn status in less than two and a half years since it was officially founded, with a company valuation of over €500M and total capital of €130M.

Get to know the amazing finalists here

John Curtius, Partner at Tiger Global, says, “Moss was able to convince us immediately with its innovative product. The modularity of the solution, in particular, enables companies to set up their spend management systems based on individual requirements and to massively streamline financial processes. We are pleased to be able to support the team to grow in their core market of Germany and expand to additional markets.”

A complete solution for spending

Moss was founded in 2020 by Ante Spittler, Anton Rummel, Ferdinand Meyer, and Stephan Haslebacher. The platform enables startups, tech companies and SMEs to issue employee and team credit cards, and manage all company spending using the Moss software platform that is powered by a proprietary card issuing and risk engine.

The product currently offers four modules that companies can deploy either as a complete integrated solution or individually. Moss enables flexible issuing of virtual and physical credit cards, digital entry and approval of invoices, processing and reimbursement of employee expenses, and reliable liquidity management. All four modules benefit from accounting automation and integrations with common accounting software and ERP systems.

Finance teams maintain complete control by having full visibility into transactions, pre-approving purchases, and adjusting all cards and limits in real-time. Additionally, all expenses can be documented with receipts and assigned to cost centres. At the end of the month, all data can be transferred to any accounting software via user-defined exports.

With Moss, users can identify trends in spending behaviour, track monthly changes, identify unnecessary expenses and thus save time and money. Going forward, customers will have the choice of using the platform as a complete solution for their spend management or build a customised modular solution based on their needs.

Moss credit cards offer high credit lines and come with payment terms of up to 60 days or attractive cashback offers. Since its inception, the company has issued more than 20,000 physical and virtual credit cards and processed over 250,000 transactions. Additionally, Moss has also witnessed growth since its funding round in August last year – the team has doubled and the number of customers quadrupled.

Funds for further expansion

Moss claims that the proceeds from this round will help it to enter the UK market, enhance the product, and further increase its workforce. Just 3 months ago, the company entered the Dutch market. Now, the startup is aiming to conquer the UK with its credit card and platform for holistic spend management.

In the Netherlands, the local team led by country manager David Soos has grown to 25 members in less than three months.

Soos says, “Moss’ strong growth in the Netherlands demonstrates that our innovative solution for spend management solves a prominent problem for companies. We are working closely with our customers and partners to continue to improve the product and with this perspective to further expand our position in the Dutch market.”

Moss will be available in the UK in the next few months with other markets following later this year. In addition to the expansion, the startup’s founders are planning product innovations in spend controlling, liquidity planning and accounting automation. This will save Moss customers more time and empower them to make better business decisions.

Moss co-founder Ante Spittler says, “There is a strong demand in the market to further digitise and automate financial processes and payments. With our solution, we want to help companies realise their full potential. This vision drives us and motivates us to constantly take Moss a step further.

To realise this common mission, the current team of more than 200 people will be expanded significantly, especially in the areas of product, technology, marketing, and sales.

How partnering up with Salesforce helped him succeed!