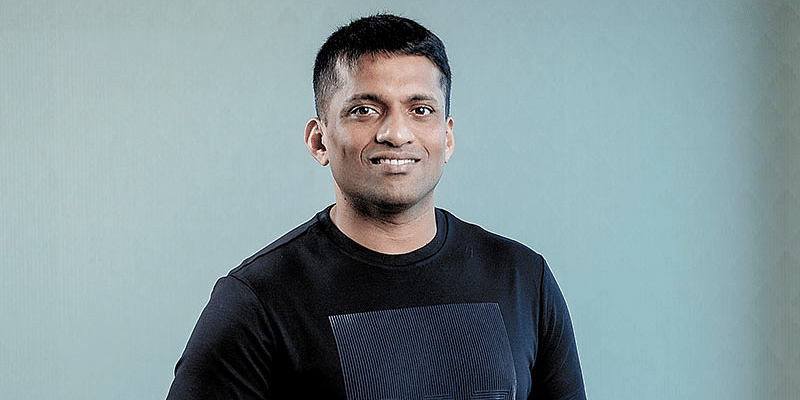

Last week, edtech unicorn BYJU’S announced a $800 million raise at a whopping $22 billion valuation. While it is remarkable that this round comes in the midst of IPO rumours, what is even more surprising is that CEO Byju Raveendran led the round with $400 million of his own capital.

According to TC, Raveendran was able to afford this investment as he got a bank loan at very favourable rates. He had to put approximately 2 percent of his current ownership down as collateral, while the new purchase of shares has also boosted his ownership of the company around 2 percent. Raveendran and his family now own 25 percent of the company.

This method of rebuilding ownership of your own startup was pioneered in the Indian startup ecosystem by Ritesh Agarwal in 2019 when he financed a move where recovered nearly $2 billion worth of shares via a traditional bank loan.

However, while OYO’s buyback was seen as risky even at the time, TC reports that Byju actually hopes to pay off his loan in a matter of quarters. Unlike Agarwal’s deal in 2019, Raveendran has not needed a third-party backer to take out the loan. OYO investor Softbank agreed to help Agarwal in his buyback.

BYJU’S is currently looking at options of going public in both America and India, although it has yet to confirm which term sheet they have agreed upon.