Even as startups struggle to raise capital, venture capital (VC) firms, especially those that back early-stage startups, are not only sitting on a huge pile of cash but are also optimistic about a return of funding activity in India.

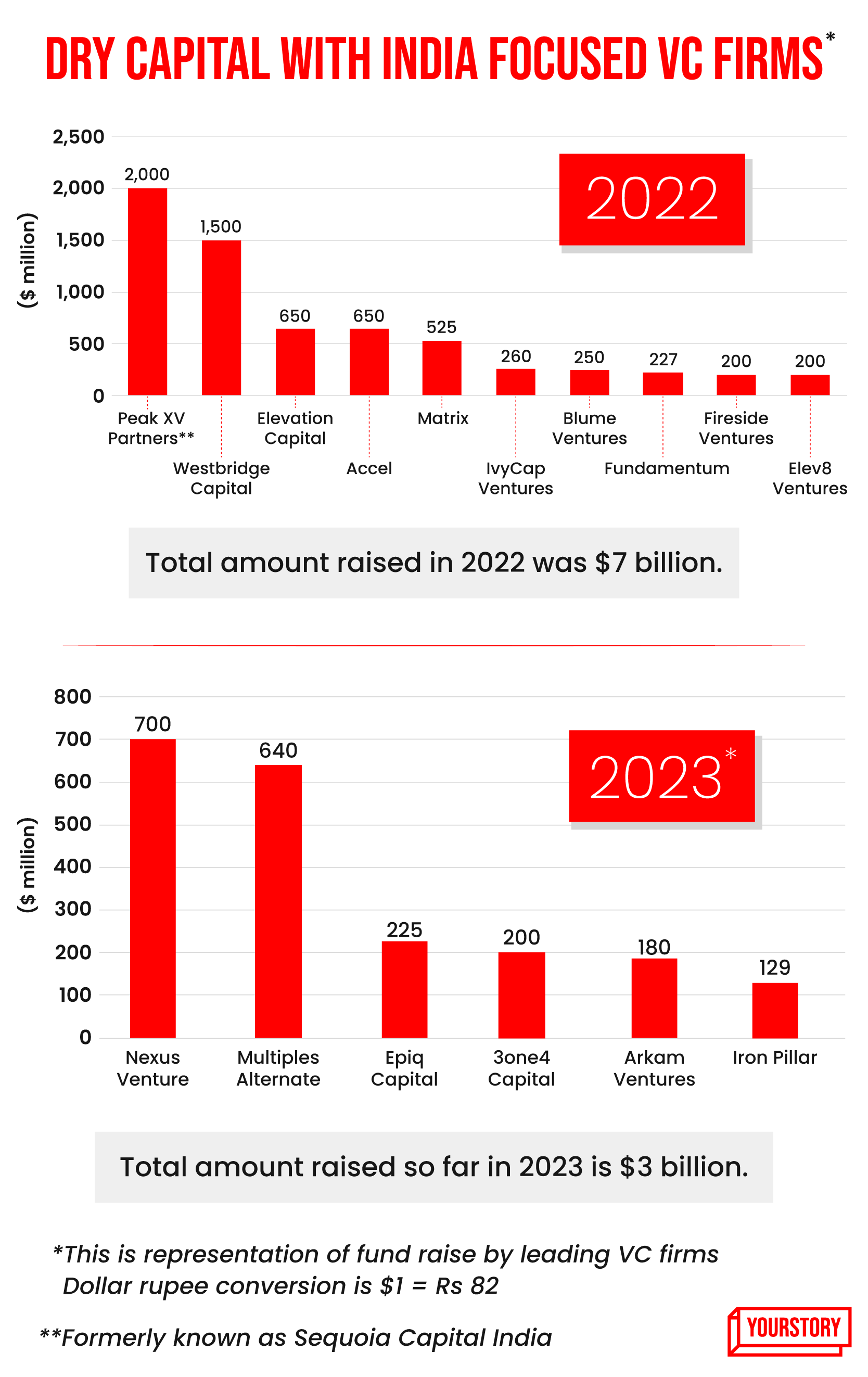

So far in 2023, VC firms have cumulatively raised around $3 billion, according to YourStory data. 3one4 Capital, Iron Pillar, and Chiratae Ventures—all of which back early-stage startups—are key contributors to this stockpile.

3one4 Capital, for example, has raised $200 million, followed by Arkam Ventures, which recently launched its second fund of $180 million. Many VC firms are on the second fund in 2023.

A few noteworthy exceptions to this trend are late-stage VC/PE firms such as Multiples Alternate Asset Management, which announced its first close of $640 million fund in May, and Epiq Capital, which closed its second fund at $225 million late last month.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

In 2022, VC firms such as Sequoia Capital India (now Peak XV Ventures), WestBridge Capital, Accel, Elevation Capital, and Matrix Partners secured around $7 billion in new fund raises.

The total cash pile available for the Indian startup ecosystem is a staggering $10 billion, the largest so far.

“There is always a lag between funds raised and its deployment. This is one of the highest amounts of dry powder that is available with the VCs,” Siddarth Pai, Founding Partner, 3one4 Capital, tells YourStory.

However, the stark difference between the fundraising in 2022 and this year is the near absence of large amounts of capital raised by VC firms. Last year, firms such as Peak XV Partners, Accel, Elevation Capital, Matrix Partners announced fundraises north of $450 million. The highest was $2 billion by Peak XV in June followed by $1.5 billion that WestBridge Capital raised in July 2022.

Investors’ choice

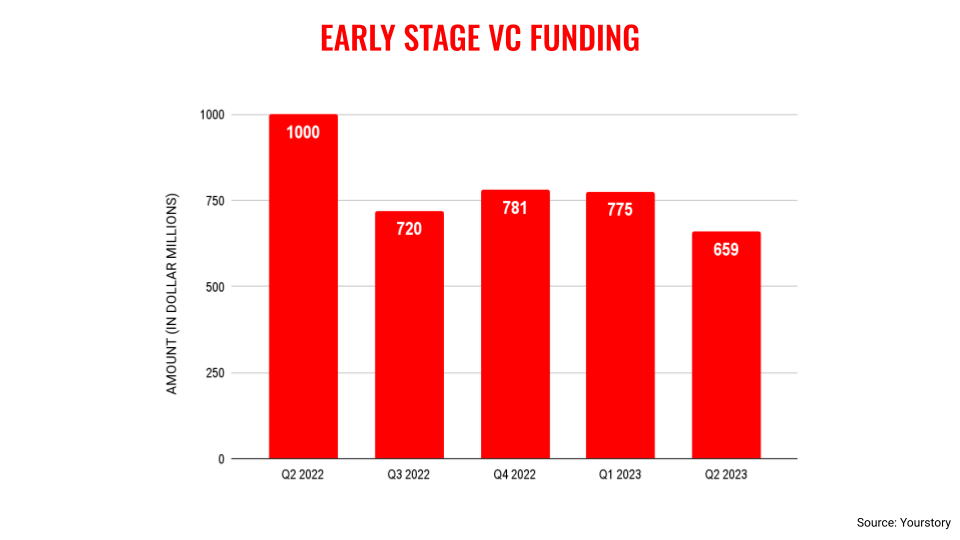

The optimism of early-stage VC firms is in line with the current funding environment. Early-stage deals accounted for 57% of the total funding in H1 CY23 (in volume terms), according to PwC’s recent report on funding trends in India.

The average ticket size per deal was $4 million. In value terms, early-stage deals contributed to about 16% of the total funding in the first half of 2023, the report noted.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

The bull run in the Indian stock markets is also drawing investor interest. India’s startup ecosystem, in particular, is under the limelight as it is considered the next big growth driver for the economy amid the current global challenges.

To be sure, the funding winter hasn’t abated. If anything, 2023 continues to see a slowdown in Indian startup investment.

Total funding in the first half of 2023 stood at $5.5 billion, a 72% drop when compared to the similar period of 2022.

Even the number of funding rounds decreased by 66% in the first half of 2023 as compared with a similar period in 2022, Tracxn noted in its recent report.

However, despite the challenges, India ranks third among the top three funded geographies globally after the US and the UK, according to market intelligence firm Tracxn.

“India still continues to be one of the fastest-growing economies. India’s startup ecosystem ranked third in terms of funding in 2022, and it moved up to second in Q1 2023, and there is a tremendous amount of growth potential,” Neha Singh, Co-founder of Tracxn, said.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

The Indian startup ecosystem has got a reality check, industry watchers say. According to Pai, there is a crisis of confidence in the market for two reasons: first, the stress in the asset portfolio of VC firms, and second, investors aren’t sure whether the investment cycle has reached the bottom of the market.

While the funding crunch has put the growth of several startups on hold, it has also pushed companies to build sustainable businesses rather than chasing the model of growth at all costs.

Startups are now talking about being operationally profitable even at the early stages which will probably help them get a higher amount of capital in the later funding rounds.

The year 2023 has so far seen zero startup unicorns or private companies with a valuation of a billion dollars or more. Pai believes that unicorns will soon return to the Indian startup ecosystem. According to him, companies that have the potential to turn into unicorns in the next four to five years have already been funded.

Investors are aware that they can’t wait for long to catch the next big startup. “If the recovery begins and then VC firms start to give out the money, they are late to the party,” Pai says.

Edited by Affirunisa Kankudti

![Read more about the article [Funding alert] Interactive coding platform Codedamn raises undisclosed pre-seed round from Antler India](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/85080f7239feebc4809b9e4a19856740eed3465e491dd8f6de1a57d885e6c67d-1625201880859-300x150.png)