India’s edtech sector has been caught in a maelstrom for a while now. The pandemic provided tailwinds for massive growth, but the reopening of offline classes and a funding winter dealt startups a double blow.

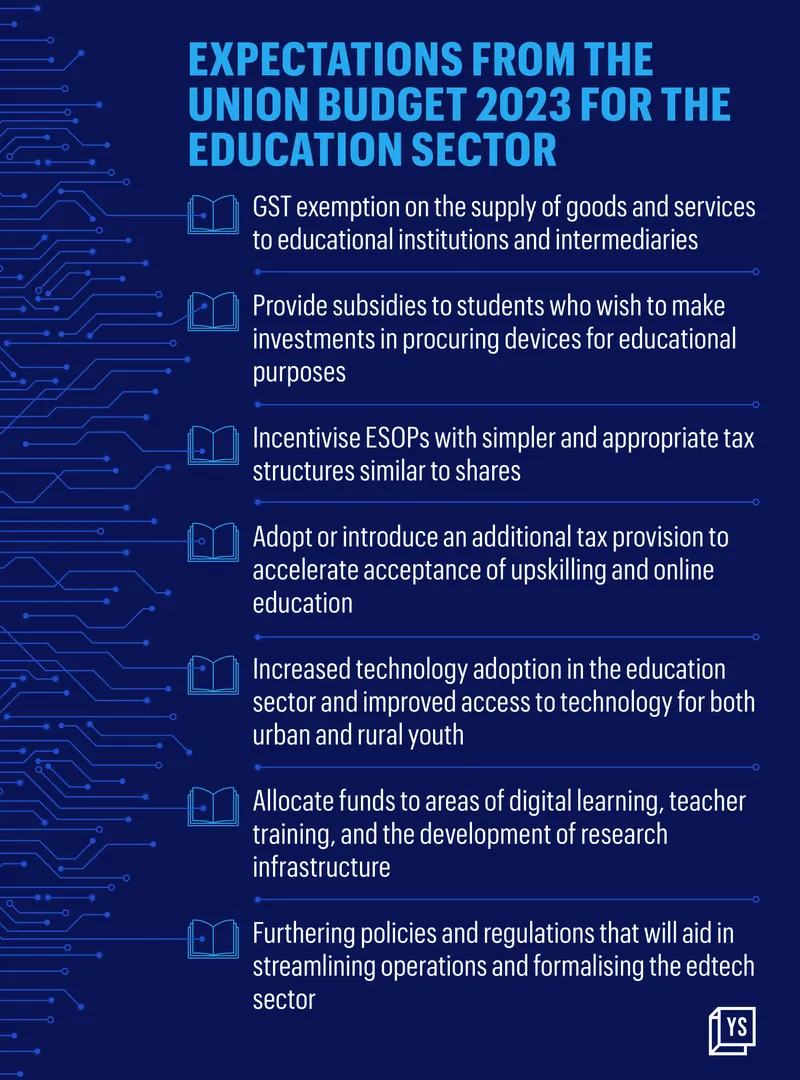

Edtech players across India are hoping that Finance Minister Nirmala Sitharaman’s Budget 2023 will remedy this. They have great expectations, including tax exemptions, lower GST, subsidies for students, better digital infrastructure, and more budget allocation for the sector, to turbocharge growth.

Budget 2022 gave a major push to the education sector with a total allocation of Rs 1,04,278 crore, an increase of nearly 12% over the previous year. Out of this, Rs 63,449.37 crore was allocated for school education and literacy, and Rs 40,828.35 crore for higher education.

In the upcoming budget, industry players are looking for the government’s push towards building a stronger digital education ecosystem that enables learning and a robust way to accelerate the implementation of the New Education Policy (NEP) 2020.

“GST exemption on the supply of goods and services to educational institutions and intermediaries can reduce the overall cost that is currently passed on to schools and parents. This will make goods and services for education more affordable, and will foster the implementation of NEP across the country,” says Sumeet Mehta, Co-founder and Chief Executive Officer (CEO) of .

The NEP, which replaced the National Policy on Education (NPE), 1986, was approved to make way for large-scale, transformational reforms in both school and higher education sectors.

Taxation system

Abhimanyu Saxena, Co-founder of and , says making educational services affordable through tax exemptions and lowering GST is a crucial move. “Since nearly half of the Indian population is under 25 years of age, policies and incentives to make quality education affordable are vital. Currently, educational services are levied 18% GST, which can significantly deter the widespread acceptance of online learning and upskilling,” he says.

Vivek Sunder, CEO of , feels that amid the increasing cost of education in the country, long-term tax exemption, lowering GST on education services, and continued funding support help edtech firms.

A few edtech players believe one must also look at how employee stock ownership plans (ESOPs) as part of public market investments are approached.

“If founders have to continue to attract a strong talent pool, taxation of ESOPs ends up being a big deterrent. Incentivising ESOPs with simpler and appropriate tax structure similar to shares will make it an attractive wealth creation opportunity, and also help startups attract and retain talent,” says Mayank Kumar, Co-founder and MD, .

Incentives and subsidies

A large section of India’s population depends on educational loans to pursue college or degree programmes. Industry leaders believe that more students could be encouraged to take up courses by reducing and subsidising interest rates on loans.

Neeti Sharma, Co-founder and President, TeamLease Edtech, says providing subsidies to students who wish to make investments in procuring devices for educational purposes, such as laptops, smartphones, and tablets, would enable many learners to upskill and get access to high-quality education at a lower cost.

The budget must also address the issue of internet and tech access for students in Tier III and IV cities through incentives and subsidies, Sharma adds.

upGrad’s Mayank says, “We expect the government to consider establishing a robust framework to lower the cost of higher education, thereby granting applicants with higher rebates and deductions in tax calculations.”

“The government can also adopt or introduce an additional tax provision to accelerate acceptance of upskilling and online education, much like how Section 80C reduces tax obligations,” he adds.

Infographic credit: Chetan Singh

Democratisation of education

Edtech players have played a key role in democratising learning after COVID-19. However, much more needs to be done.

“There is a massive surge in students and professionals opting for online courses, especially in Tier II and III cities. The challenge arises in creating stable digital infrastructure for such cities,” says Nikhil Barshikar, Founder and CEO of .

Scaler’s Abhimanyu says learners across Tier II and III colleges should also be acquainted with industry-specific curriculum and updated according to present standards of the tech industry. However, such a large-scale rejig cannot happen overnight. “Only with the support of the government and through a directed focus can this be implemented,” he adds.

Industry players are looking forward to increased technology adoption in the education sector and improved access to technology for both urban and rural youth as more edtech companies strive to provide education to students from Tier II, III, and IV cities.

LEAD’s Sumeet says the NEP promotes the use of technology in teaching and learning, and the direction of the Ministry of Education is to promote multimodal learning so that high-quality resources are made available to all students, irrespective of location or background.

“This can be enabled by increasing the penetration of digital infrastructure in schools and educational institutions. Digital tools and content in smart classrooms are key to enriching students’ learning,” he says.

Policy and funds

Apart from these expectations, edtech founders want the government to announce initiatives and allocate funds to stimulate the growth of the sector.

Krishna Kumar, Founder and CEO of , says Budget 2023 should focus on strengthening infrastructure and introducing policies.

“The government could consider furthering policies and regulations that will aid in streamlining operations and formalising the edtech sector. It could also consider incentives for edtech companies that comply with guidelines proposed by the government and who choose to bring in self-regulatory policies to make their services more transparent to stakeholders,” he says.

Budget 2022 included key proposals such as Digital University, to provide education on a hub-and-spoke model; DESH-Stack e-portal, a digital ecosystem for skilling and livelihood; and expansion of One Class, One TV Channel programme under PM e-VIDYA scheme from 12 to 200 TV channels.

Vamsi Krishna, Co-founder and CEO of , says that the expectation is greater now from the government. “We expect the government to frame a policy structure that could encourage schools to expand online learning efforts by enabling them with more education technology,” he says.

Edtech is here to stay and Indian edtech firms have a great opportunity to take their learning modules and strong pedagogy to learners across the globe, says Cuemath’s Vivek Sunder says, adding that allocating funds to areas of digital learning, teacher training, and the development of research infrastructure is therefore necessary.

With companies in the edtech space witnessing losses, laying off employees, slowing expansion plans, and trying to conserve cash amid a funding winter, Budget 2023 will be a crucial factor to sustain the growth India’s education sector has seen over the past three years.

Vedantu’s Vamsi calls for reforms in the online learning space to nurture new ideas and technologies, which “will catalyse further innovation and growth”.