As Indian edtech goes through the biggest churn in its short lifetime, teachers and course creators are paying a big price for business failures

When edtech was booming in India, teachers were venerated. The so-called democratisation of education gave rise to startups and tech products dedicated to teachers and educators. We heard about how teachers across India are adapting to edtech tools and methodologies and that this was the future — how quickly things change.

As Indian edtech goes through the biggest churn in its short lifetime, these tall promises have been forgotten. For India’s edtech teachers and course creators, it’s not about business models or profitability — it’s a question of livelihood and their very future in the education system. Before we look to see if there are any answers, here are three ‘ICYMI’ stories that you need to read right away:

Who Needs Teachers For Edtech?

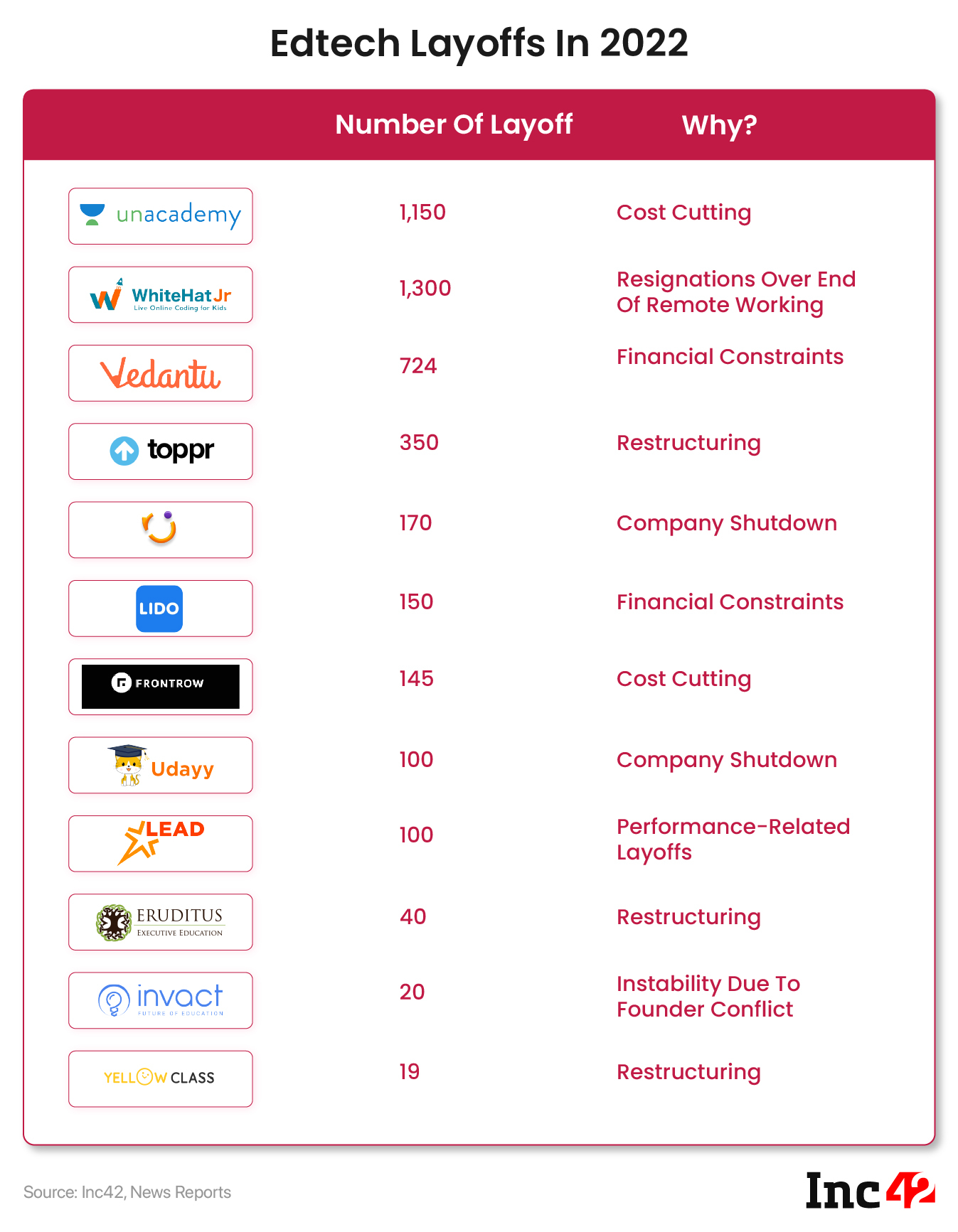

More than 4,200 employees — full-time and contracted — at edtech startups in India have been laid off in the first six months of the year and LEAD being the latest. In many cases, these are teachers and educators that have been working from home during the pandemic, when the prospects of startups were booming.

But now as edtech giants compete with India’s traditional offline learning centres where the demand is moving — and with VC funds not as easily accessible — teachers are being asked to leave amid downsizing and operations being put on hold. There is a feeling that this is the end of edtech as a viable career opportunity for many teachers and educators, according to many such employees that we have spoken to over the course of the past few weeks.

According to the Indian Edtech Consortium, the sector has generated more than 75,000 jobs for the Indian workforce in the last five years and currently employs close to 50,000 people.

From Heroes To Zeroes

While edtech startups have always sold a narrative of being changemakers, the current market situation in India and globally has forced them to become mere businesses.

The focus is on the bottomline or at least the cold hard numbers and unfortunately, the employees that contributed to the user experience are feeling the heat. This is a swift U-turn from the pro-teacher statements from Indian edtech companies over the past couple of years.

WhiteHat Jr claimed it was changing the narrative around diversity by creating teaching jobs for women at home, but employees resigned in droves when the company forced them to work from the office.

Unacademy went a step further and even introduced stock option plans for teachers or TSOPs worth $40 Mn. Whether these options were actually allocated to the teachers is unclear. And as we have said before, Unacademy has become a poster child of this downturn in India’s edtech ecosystem.

More Layoffs At Unacademy

After laying off 1,150 employees in three waves from the core Unacademy platform, the group has turned to Relevel in another bid to cut costs and restructure its operations. Besides this it has also suspended contracts of other educators that were part of the doubt-solving team.

Despite denials of layoffs of over 100 employees in the past week, Inc42 has learnt from sources within Relevel that the company is yet to deliver on the interviews promised to these impacted employees.

Employees allege the company is now looking to cash in on the work put in by the ‘Course’ teams, which is bringing in the revenue. while the team behind the free ‘Tests’ product is largely being retained.

At the moment, the company is only earning revenue through these courses and does not charge learners or the companies that recruit through Relevel.

Those in the course creation team claim this is sheer profiteering and that the operations cannot be managed by the current employees. “The company can simply keep selling these courses for a year or so and keep making money, but there’s a lot of day-to-day course management. They don’t have the people to do it,” a Relevel employee told Inc42.

While on the online learning side, teachers are being asked to leave, in the offline space, Unacademy is spending millions to bring teachers on board to use them as a lead magnet for students. It is offering annual income in the range of INR 1 Cr – INR 10 Cr to teachers, as reported by Inc42 in June.

Indian Edtech’s Trust Problem

Startups pivot when things are tough and expand when they have the funding, but many teachers now claim that perhaps the cost of getting a chance to innovate is not worth going back to edtech, especially as most of these companies are now looking to expand offline.

“I went from BYJU’S to Relevel but now they are asking me to join Unacademy, but that does not fit my profile at all. And that’s only if I pass the interview, so it’s a test to keep my job,” said one of the Relevel employees who is among those asked to interview for roles within Unacademy.

Those let go from Vedantu and Toppr claim there’s a severe lack of trust in any edtech platform in India. After all, how many times can one jump from one company to another before completely leaving the sector? And there’s no stability in the edtech business even in good times, many claim.

Without the educators innovating and bringing their expertise in creating engaging learning content, isn’t edtech in India just a collection of startups selling digital textbooks and running coaching centres?

Tech Stocks & Startup IPO Tracker

- Cloud-based architectural design software startup Infurnia Holdings has filed its DRHP with SEBI for raising INR 38.2 Cr via an initial public offering

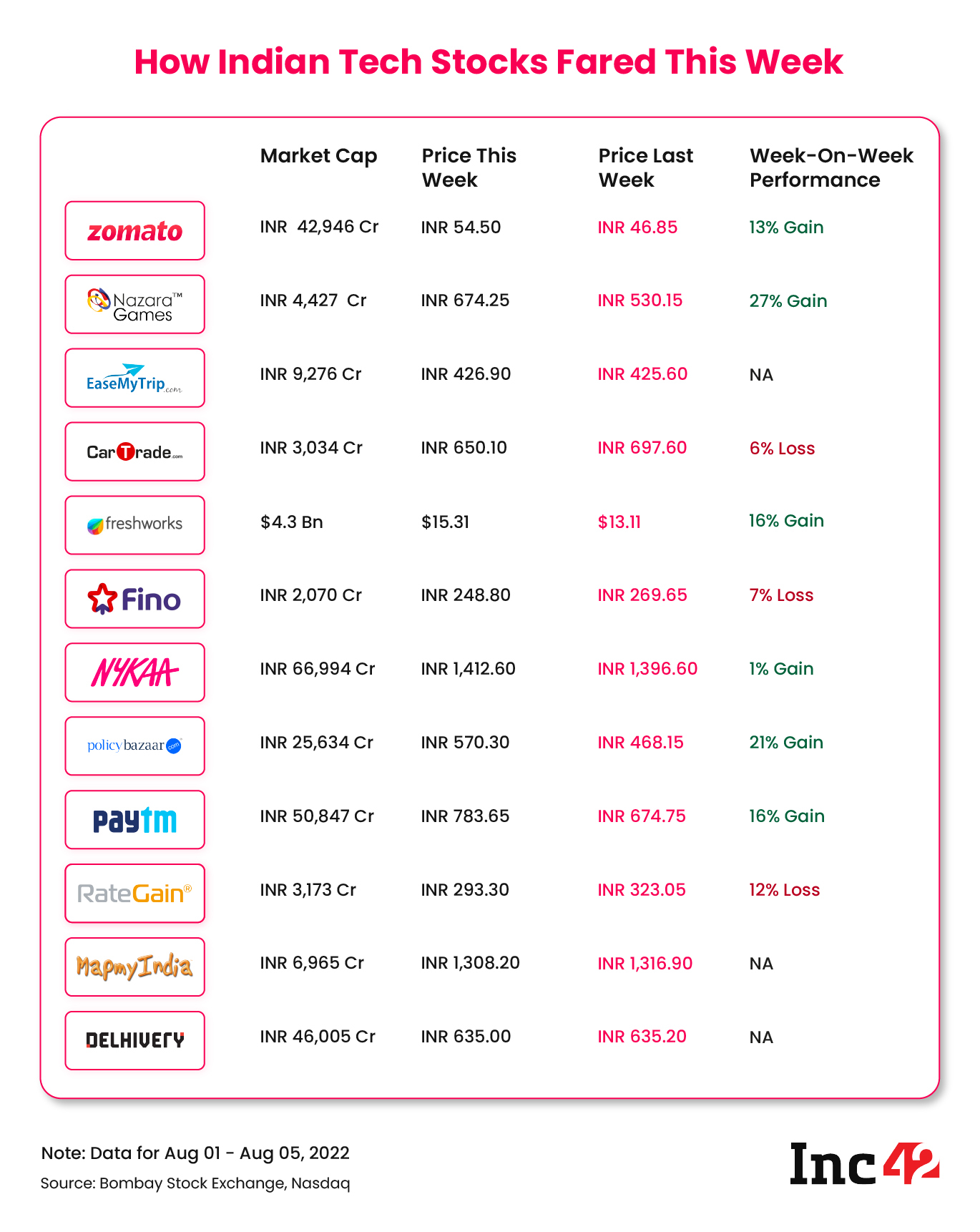

- Zomato have halved its losses at the end of the Q1FY23 to INR 186 Cr from INR 360 Cr from the yearago period, with the food delivery business achieving adjusted EBITDA breakeven

- Fintech giant Paytm’s consolidated losses grew by a whopping 69% to INR 645.4 Cr compared to last June, but fell 15% from the previous quarter

- Nykaa reported a net profit of INR 5 Cr in Q1 of this current fiscal year, more than 50% lower than the INR 7.6 Cr reported in the quarter ending March

- MapmyIndia reported a 17.5% year-on-year (YoY) jump in consolidated net profit at INR 24.2 Cr with automotive and mobility tech revenue surging

- Infibeam Avenues reported a 69% growth in profits to INR 23 Cr in Q1 FY23 compared to last year on the back of a shift towards digital payments

Here’s how the past week has been for the listed tech companies we are tracking:

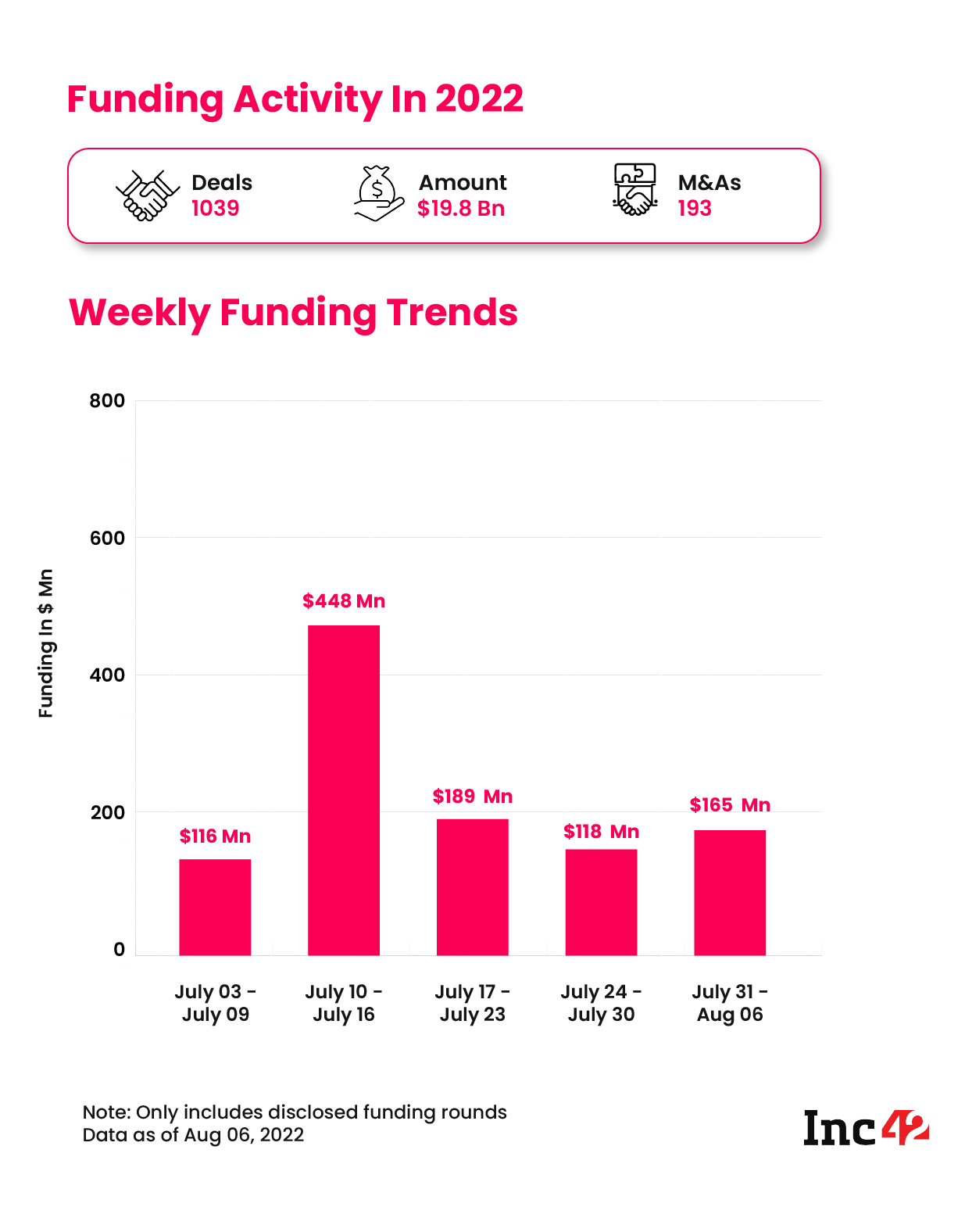

Startup Funding Tracker

30 Startups To Watch & Other Top Stories

That’s all for this week. Look forward to seeing you next Sunday with another weekly roundup.