Reports suggest that banks are wary of providing financial services to crypto exchanges

WazirX cofounder and CEO Nischal Shetty has alleged that Indian banks still cite RBI’s 2018 decision to deny banking services to crypto companies

The news comes months after it was reported that Indian banks such as ICICI Bank, HDFC Bank, State Bank of India and Yes Bank had started providing financial services such as loans and working capital to crypto companies based in the country

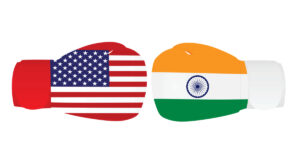

Indian cryptocurrency exchanges have alleged that payment gateways are blocking their transactions on instructions from some of the country’s leading banks.

“Confusion in India’s banking industry is hurting 1.5 CRORE Indians in Crypto. The Honourable Supreme Court of India has set aside the RBI crypto circular of 2018. Banks in India still cite that circular to deny banking,” Nischal Shetty, cofounder and CEO of Mumbai-based cryptocurrency exchange WazirX wrote on Twitter on May 4.

Shetty was referring to RBI’s 2018 decision to bar banks from providing services to crypto companies. In March 2020, the Supreme Court struck down that RBI decision as ‘unconstitutional’. However, reports suggest that banks are still wary of providing financial services to crypto exchanges.

Last week, ET reported that ICICI Bank had been distancing itself from processing payments to crypto exchanges. The Bank is understood to have told some payment gateway operators to shut off ICICI net banking for merchants who are involved in buying or selling cryptocurrencies.

“I request banks in India to update their compliance teams about the Supreme Court ruling that set aside the RBI circular against Crypto. It’s not fair that the crypto industry has a clear go-ahead from the Supreme Court of India and yet banks deny banking to the industry,” Shetty added on Twitter.

The news comes months after it was reported by several media outlets that Indian banks such as ICICI Bank, HDFC Bank, State Bank of India and Yes Bank had started providing financial services such as loans and working capital to crypto companies based in the country. According to the ET report, ICICI Bank was one of the last few big lenders providing services to crypto exchanges. As the Bank discontinues these services, others may follow suit.

Sathvik Vishwanath, cofounder and CEO of Unocoin, one of India’s oldest crypto exchanges, was informed last week by ICICI Bank that his company’s account with the bank was being suspended.

A possible reason why banks are discontinuing their services to crypto companies could be increased investment activity in the crypto market due to the rapid rise in the price of Bitcoin. Several investors are being drawn towards crypto because of promises of high returns. A bank’s risk and compliance team could flag these transactions to protect their customers’ money and suggest suspending partnerships with crypto companies.

Indian crypto stakeholders have been waiting with bated breath since February for a final word from the government on regulation for the sector. The Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, was supposed to be tabled in the budget session which ran in two phases from February to March. However, since the session ended prematurely, the bill didn’t come up for discussion.

The bill’s synopsis talked about banning all private cryptocurrencies in India but allowing certain exemptions to promote the underlying technology of cryptocurrency and its uses. Despite the bill mentioning a ban on private cryptocurrencies, statements from the finance minister and other government representatives, where they’ve talked about leaving a window open to allow experiments in crypto, have assuaged fears of the founders of Indian crypto companies.