Le Travenues Technology, which operates travel platform ixigo, looks to raise INR 1,600 Cr through IPO

Offer to include an issue of fresh shares worth INR 750 Cr and an offer-for-sale amounting to INR 850 Cr

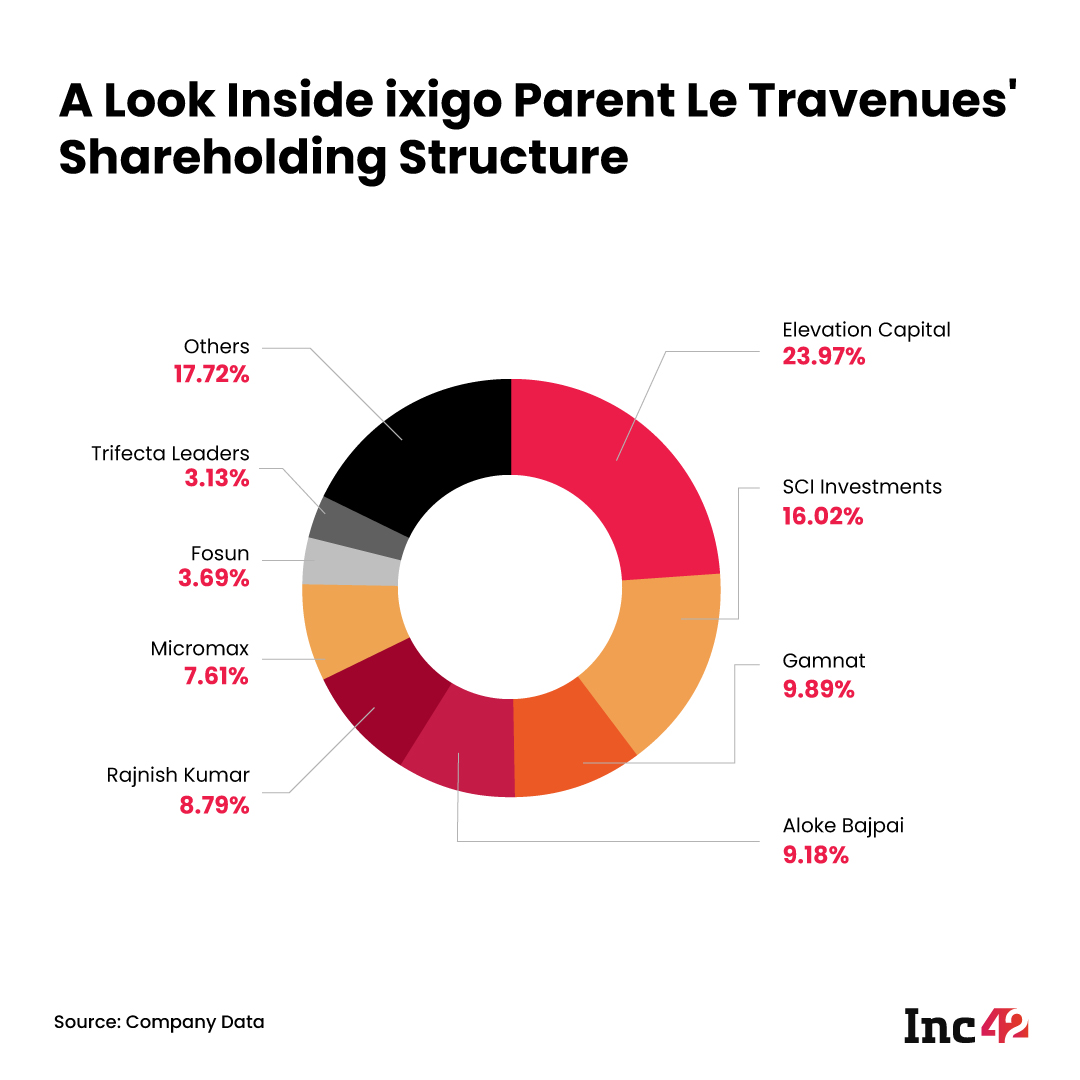

Elevation Capital and SCI Investments are biggest shareholders in the company

Gurugram-based online travel ticket aggregator Le Travenues Technology, parent company of ixigo, has filed its draft red herring prospectus (DRHP) with market regulator SEBI and is eyeing to raise INR 1,600 Cr through an initial public offering. The travel aggregator’s offer includes an issue of fresh shares worth INR 750 Cr and an offer-for-sale worth INR 850 Cr.

The company’s financials revealed that it posted revenue from operations worth INR 135.5 Cr in FY 21, up by 21.5% from INR 111.5 Cr it posted in March end last year. The platform’s total expenses dropped to INR 135.6 Cr in FY 21 from INR 139.5 Cr in FY 20. ixigo posted a profit of INR 7.53 Cr in FY 21, compared to a loss of INR 26.6 Cr in FY 20.

ixigo is backed by Elevation Capital (earlier called SAIF Partners), SCI Investments, Trifecta Leaders, Fosun RZ Capital among others. Elevation Capital and MakeMyTrip were the early investors in ixigo. In 2011, Elevation Capital and Nasdaq listed MakeMyTrip invested 76.6% of ixigo’s share for $18.5 Mn. MMT is said to have received an 8x return on its investment to the tune of $38.5 Mn when it exited ixigo during the latter’s Pre-IPO round worth $53 Mn led by GIC. Infoedge, Bay Capital, Trifecta, among others participated in the round. As per the DRHP, MMT used to hold 10.33% in the ixigo until last year. The company to date has raised $88 Mn in funding.

As per the DRHP, cofounders Aloke Bajpai and Rajnish Kumar will offload shares worth INR 50 Cr respectively. While Elevation Capital will be offloading INR 550 Cr of shares, Micromax will be selling shares worth INR 200 Cr. At present Elevation Capital owns 88,563,200 and Micromax holds 28,110,400 of shares in the company.

How ixigo’s Shareholding Pattern Looked Like Pre-IPO

Early investor Elevation Capital is the largest shareholder in the company as it owns 23.97% stake in the company. SCI Investments held the second largest stake with 16.02% followed by Gamnat’s 9.89%. Cofounders Aloke Bajpai and Rajnish Kumar own 9.18% and 8.79% stake respectively in the company. Smartphone manufacturer Micromax on the day of filing was the sixth largest stakeholder with 7.61% stake.

About 14 of shareholders with more than 1% stake own 96.12% of stake in the company.

Launched in 2007 by Bajpai and Kumar, ixigo offers bus, train, flights tickets along with real-time comparison on their prices, and their availability. The company has divided its apps based on user-interest— ixigo Train app and ixigo Flight app. Both the platforms cumulatively boast of having 37.48 Mn monthly users and 2.44 Bn monthly screenviews.

Earlier this year in February, ixigo acquired train booking app Confirmtkt to fulfil post-covid demand. Earlier this month, ixigo acquired a bus ticketing platform called AbhiBus. Post the acquisition, AbhiBus has managed to hold 2.31% in the company. ixigo joins the likes of Zomato, Paytm, Nykaa, Mobikwik, CarTrade and Fino Payments Bank, in going for an IPO this year.