Image credit: Rewire

Israel-based Rewire, a fintech startup that develops cross-border online banking services, has raised $20M (approx €16.5M) in its Series B round of funding and has also received a significant line of credit from a leading bank.

Investors in this round

The Series B was led by OurCrowd, and included new key investors Renegade Partners, Glilot Capital Partners (via their early growth fund Glilot+), and Jerry Yang, former Yahoo! CEO and director at Alibaba, through AME Cloud Ventures.

Current investors include Viola Fintech, BNP Paribas via Opera Tech Ventures, Moneta Capital, and private angel investors.

The current round of funding will enable the fintech startup to continue enhancing its product portfolio and services, as well as its strategic partnerships in the migrant’s country of origin and the country in which they currently reside.

How does Rewire solve the cross-border needs of migrants?

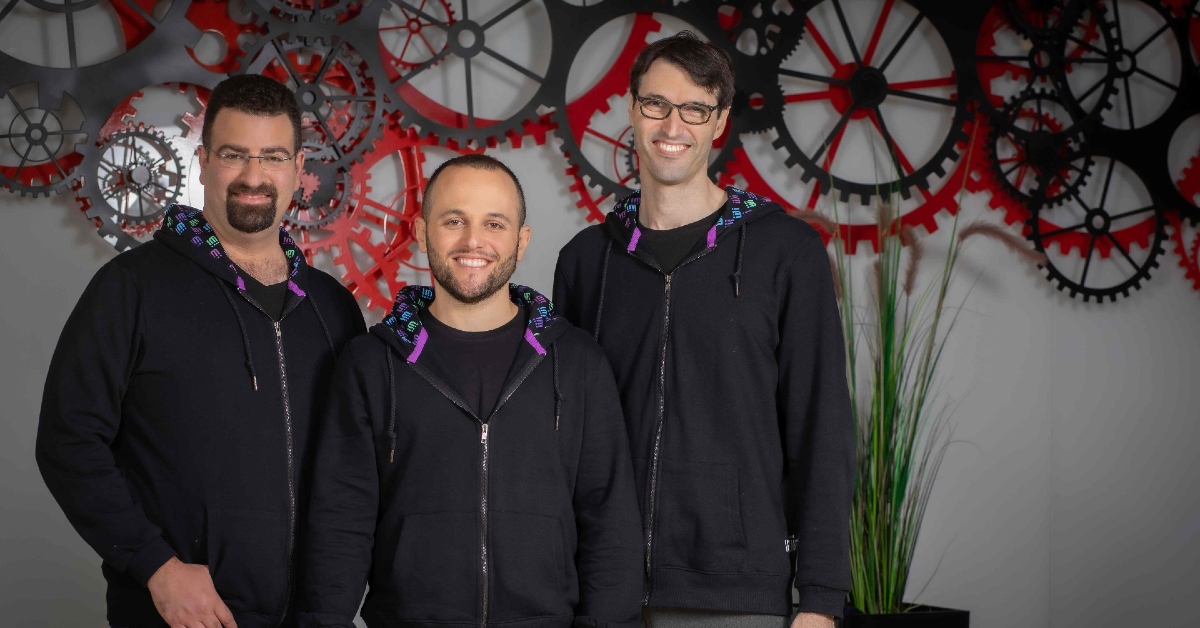

Rewire is the first neobank for migrants worldwide. It was founded in 2015 by entrepreneurs Guy Kashtan (CEO), Adi Ben Dayan (VP R&D), Saar Yahalom (CTO), and Or Benoz.

To answer the unique cross-border needs of migrants, Rewire uses its technology and develops strategic partnerships with leading financial institutions in the migrant’s country of origin and in their new home. The fintech is able to provide the accessibility of financial services to migrants, including the transfer of money and payment accounts to upcoming advanced financial services such as bill payments, savings, and mortgage loans.

Rewire’s customer base includes migrated immigrants from Europe from over 20 countries in Asia and Africa such as the Philippines, Nigeria, India, Thailand, and China. With the help of technology, strategic partnerships, and values of equality, inclusivity, and social good, Rewire is able to provide financial services to make immigrants feel at home.

Partnerships

Rewire partners with leading financial investors and banks such as BNP Group and Standard Bank of South Africa (SBSA), one of the largest banks in Africa. Rewire integrates banking services into its platform and provides global accounts to its customers.

Rewire is expanding to serve customers from additional countries in Asia and Africa in the near future.

Licences are major steps towards fulfilling Rewire’s vision?

Rewire has recently secured its EU Electronic Money Institution licence (EMI), granted by the Dutch Central Bank, which allows the fintech startup to (a) issue electronic money, (b) provide payment services, and (c) engage in money remittance.

The fintech was also granted an expanded Israeli Financial Asset Service Provider. By acquiring these licenses, Rewire believes it is in the right direction to provide secure and accessible financial services for migrant workers worldwide.

Rewire CEO, Guy Kashtan says, “At our core, we aim to create financial inclusion. Everything that we do at Rewire is aimed to help migrants to build a more financially secure future for themselves and their families. To do so, we aim to provide services that go beyond traditional banking services such as insurance payments in the migrant’s home country and savings accounts. This investment and licenses are major steps towards fulfilling our company’s vision and will be used for additional expansion of geographies and products.”

To boost its cross-border solution, besides offering remittance services, payment account, and debit card, Rewire plans to add new value-added services to its platform such as bill payments and insurance, in addition to credit and loan services, investments, and savings. With these services, Rewire is able to make its first-rate financial services more accessible to migrants and, thus, include them in the financial systems.

Growth during the pandemic

In 2020, despite the Covid-19 pandemic, Rewire saw success. With $500M (approx €413.27M) processes through its systems, the company claims to have tripled its customer base in 2020 and will soon reach 0.5M registered users, with 40 per cent attributed to organic growth.

Rewire has penetrated new markets in Europe and the UK and introduced new cross-border bill payments. It has established solid partnerships with prominent financial institutions in multiple countries such as UkrSibbank in Ukraine and mobile wallet enablers in Nigeria and the Philippines.

Serving dozens of nationalities, Rewire offers its cross-border solution in 8 different languages and a localised app.

![Read more about the article [Funding roundup] Semaai, GreenPod Labs, Insurmile, and others raise early-stage deals](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/Image03w0-1640781482458-300x150.jpg)

![Read more about the article [Product Roadmap] How Uber India is leveraging product thinking and technology to drive innovation](https://blog.digitalsevaa.com/wp-content/uploads/2021/09/Dara1559963989780-300x150.png)

![Read more about the article [Funding alert] Online retail platform Dukaan raises $11M in pre Series A round](https://blog.digitalsevaa.com/wp-content/uploads/2021/09/Dukaan-09-1630904591812-300x150.png)