Image credits: Cognitive Credit

Cognitive Credit, a London-based enterprise software company focused on the global corporate credit market, announced that it has raised £6M (approx €7.1M) funding in a Series A round.

The round was led by Fitch Ventures, the equity investment arm of Fitch Group, with XTX Ventures, Pentech, and several industry insiders participating. The company has raised £10M in funding to date.

Get to know the amazing finalists here

Fund utilisation

The €7.1M funding will enable the UK company to extend its market leadership, grow its team, and expand to the US market.

The company is also planning to launch multiple products across global credit markets in the coming year. The company is hiring across its engineering, commercial, and data divisions in both regions (the UK and US).

What does Cognitive Credit solve?

Corporate credit is one of the world’s largest investment markets at over $10T. Yet credit analysis remains a specialist domain overlooked by the major financial technology providers.

Every year, institutional investment firms spend millions searching to analyse data essential to their businesses, which is not only time-consuming but tedious and prone to human error.

Provides precise corporate credit analysis

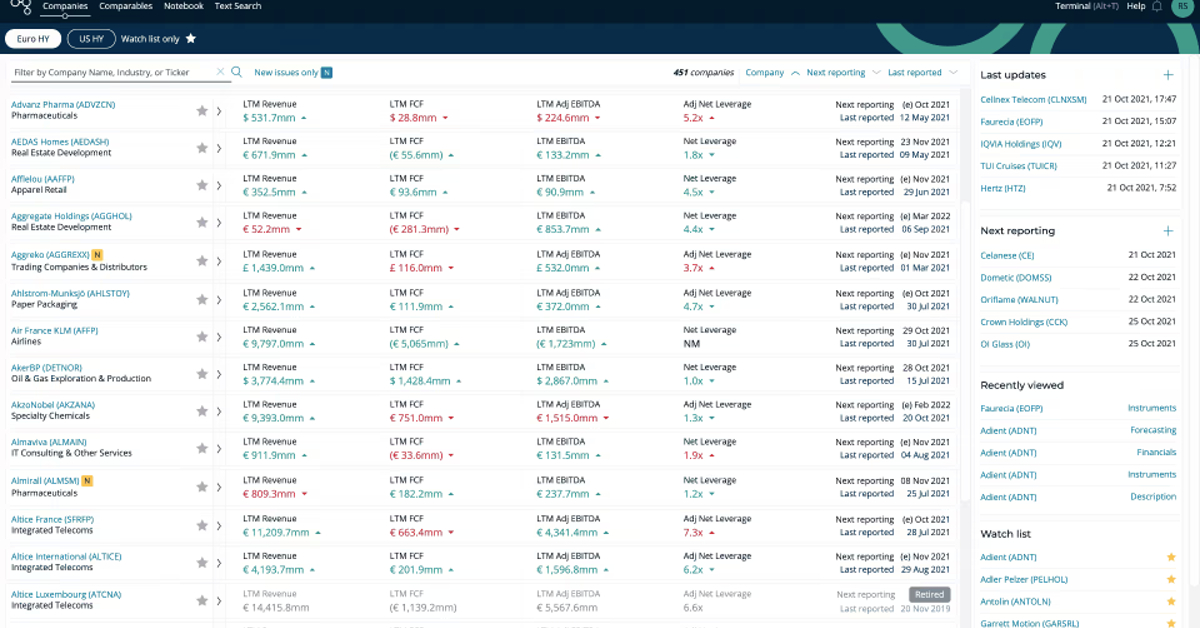

Cognitive Credit provides data-driven software that combines productivity tools with analytical features enabling efficient and precise corporate credit analysis.

The company’s software relieves investment teams of mundane, repetitive data processing so that they can allocate more time to their value-added work.

The London-based company works with the world’s leading investment banks, asset managers, hedge funds, and financial/legal advisory firms.

Robert Slater, CEO and Founder of Cognitive Credit, says, “Every day we strive to push the boundaries of what technology can do for credit investors, and we see huge opportunities to collaborate with our new strategic partners in this area. We have received phenomenal feedback from clients over the past year, and with this capital raise and near-term additions to the team, we couldn’t be more excited about our global expansion and further product roll-out in 2022.”

Investors

Fitch Ventures makes equity investments in innovative and emerging technology companies in the financial services industry to help accelerate their commercial growth. With dual headquarters in London and New York, the company has operations in more than 30 countries.

Shea Wallon, Managing Director at Fitch Ventures, says, “Cognitive Credit is transforming the way credit market participants access fast moving data and insights to make investment decisions. Its cloud-based platform, powered by robust AI/ML, enables its clients to maximise their analytical capabilities across investment, trading, and advisory businesses.”

How partnering up with Salesforce helped him succeed!

![Read more about the article [The Outline By Inc42 Plus] Indian Ecommerce Goes Social + Vernacular](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/1200x628-8-300x157.png)

![Read more about the article [Funding Galore] Over $365 Mn Raised By Indian Startups This Week](https://blog.digitalsevaa.com/wp-content/uploads/2022/03/Social_Image-14-mar-19-mar-300x157.jpg)