In the current scenario with Zomato’s Initial Public Offering (IPO), a number of new-age companies like Nykaa, PayTM, etc. are getting ready to debut in the public market and are thus, attracting a lot of retail and institutional investors.

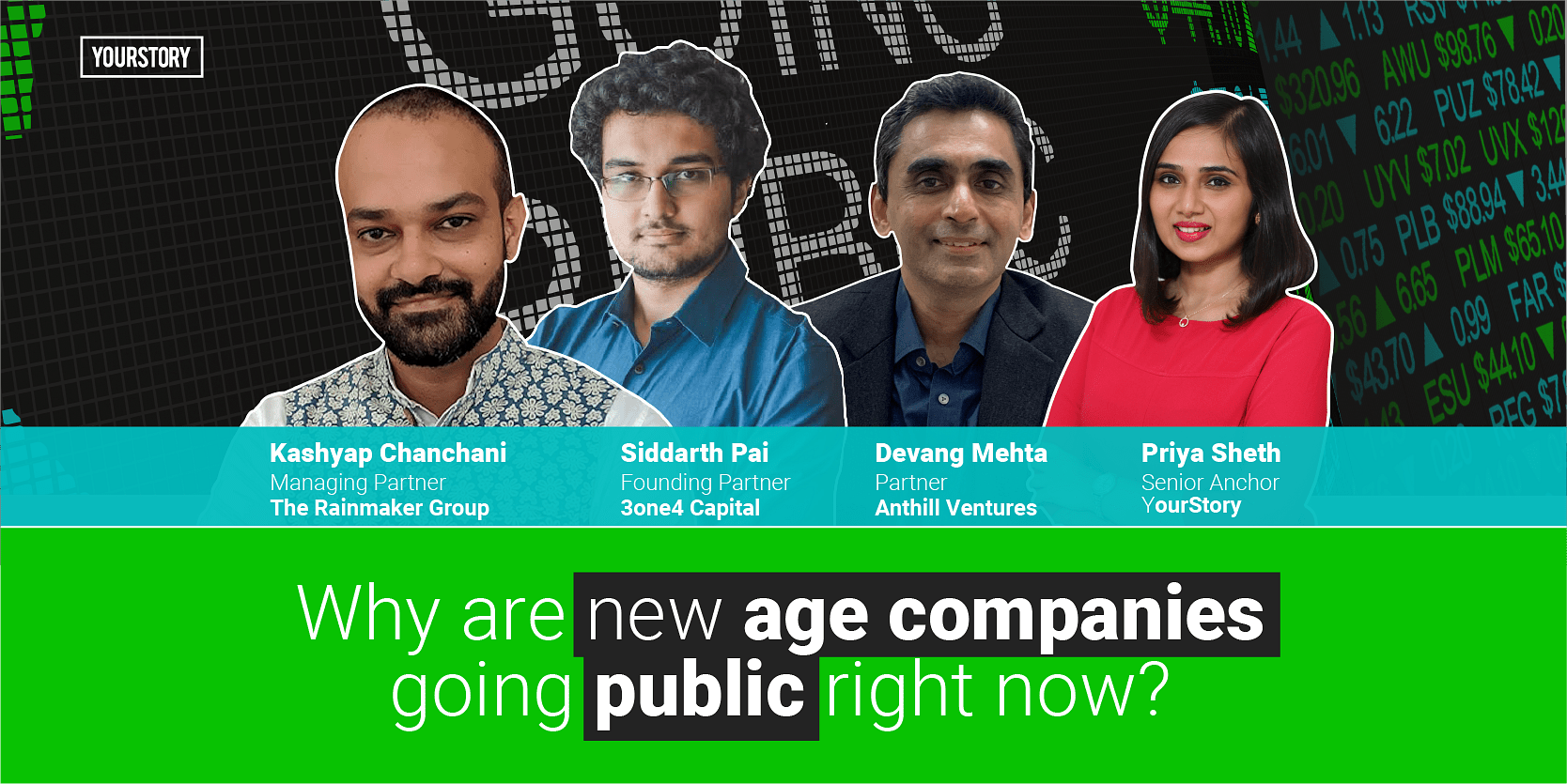

Kashyap Chanchani, Managing Partner, The Rainmaker Group, said companies go public when the markets are predictable, when there is a need to go IPO from the shareholders’ perspective, and when companies are prepared to take that leap and become a public company.

“Zomato was probably the most prepared company in our entire ecosystem to go public,” said Kashyap, adding that Zomato had been a quasi-public company for a very long time. “They already learnt things the hard way as years before they went public, they made their financials and numbers public.”

Devang Mehta, Partner, Anthill Ventures, believes it is a great time for companies to go public and early-stage investors will make fantastic gains. However, he feels that one thing that has changed in recent times is that Indian investors are now more mature and look at growth metrics apart from profitability.

“Historically, we have been a conservative market where profitability is a must for three to five years to go public. A lot of those norms have been relaxed by SEBI,” Devang said. Profitability is thus not necessarily the best metric to judge growth.

Large amount of liquidity in market

Siddarth Pai, Founding Partner, 3one4 Capital, explained that there is an unprecedented amount of liquidity in the system, owing to the global pandemic. In 2020, growth came to standstill as the entire world went into lockdown. Technology has taken a front seat in current times and the propensity of people to value technology is also high. “Everyone is chasing growth and technology holds the greatest promise of growth,”

he said.

The combination of the pandemic, a large amount of global liquidity, the confidence after investors have seen other companies deliver good returns, and the fact that consumers are now familiar with these companies is causing a large number of tech startups in India to look at IPOs, he said.

Kashyap added that a lot of late-stage companies are being tracked closely by the public market investors.

Thus, these companies are not unfamiliar assets and their stories have been well digested.

If a company is approaching platform economics through unprofitable means, it still could be a great story from a stock’s standpoint, Devang said. “Amazon in their initial years kept on investing and putting money into growth and, at some point, there is very little competition,” he said.

Addressing needs of millennials

Devang added that people are looking at millennials now in terms of how they live, share, or move from point A to point B and consume. Companies with the technology to address the needs of the millennials will have to show that in their trajectories.

Returning to Zomato, Siddarth said the foodtech unicorn has been upfront about the fact that they have invested heavily into their business by increasing discounts as they want to create a behavioural pattern in their consumers. “The stickiness that has happened right now is immense. When you think about food, you think about Swiggy or Zomato,” he said.

Behavioural patterns of the consumers have changed, and these companies have engineered those patterns. Investors look at the loss drivers of companies and how quickly can they change.

Kashyap said companies like Asian Paints or Unilever are trading at high values because they are very strong brands and “respective market leaders”. The public market operates in a very different way as compared to the private market. “In a public market every day, the company is being judged and people are voting with their money,” he said.

Devang said it is important to note that all favourable geopolitical tailwinds are helping the Indian tech sector. “Only a finite amount of money can go into US or UK assets,” he said. For diversification purposes, the money has to go somewhere in Asia – and India is the best market to go to.

Kashyap concluded by saying that investors look at growth, corporate governance, and potential longevity of the businesses as compared to other traditional businesses. “Almost all these IPOs would sail through without any problem,” he said.

Devang said as long as tech startups hit a growth stride like Zomato, Paytm, or PolicyBazaar did, they will remain viable candidates to hit the stock market. The demand will be very high and it would be a great change for the Indian stock market if the investing fraternity understands the economics of growing tech companies as different from traditional manufacturing companies.

Siddarth ended by saying that technology will stay the dominant theme over the next 100 years. “IPO is not actually the end goal; it is the beginning of an entire journey in the public market stream,” he said.