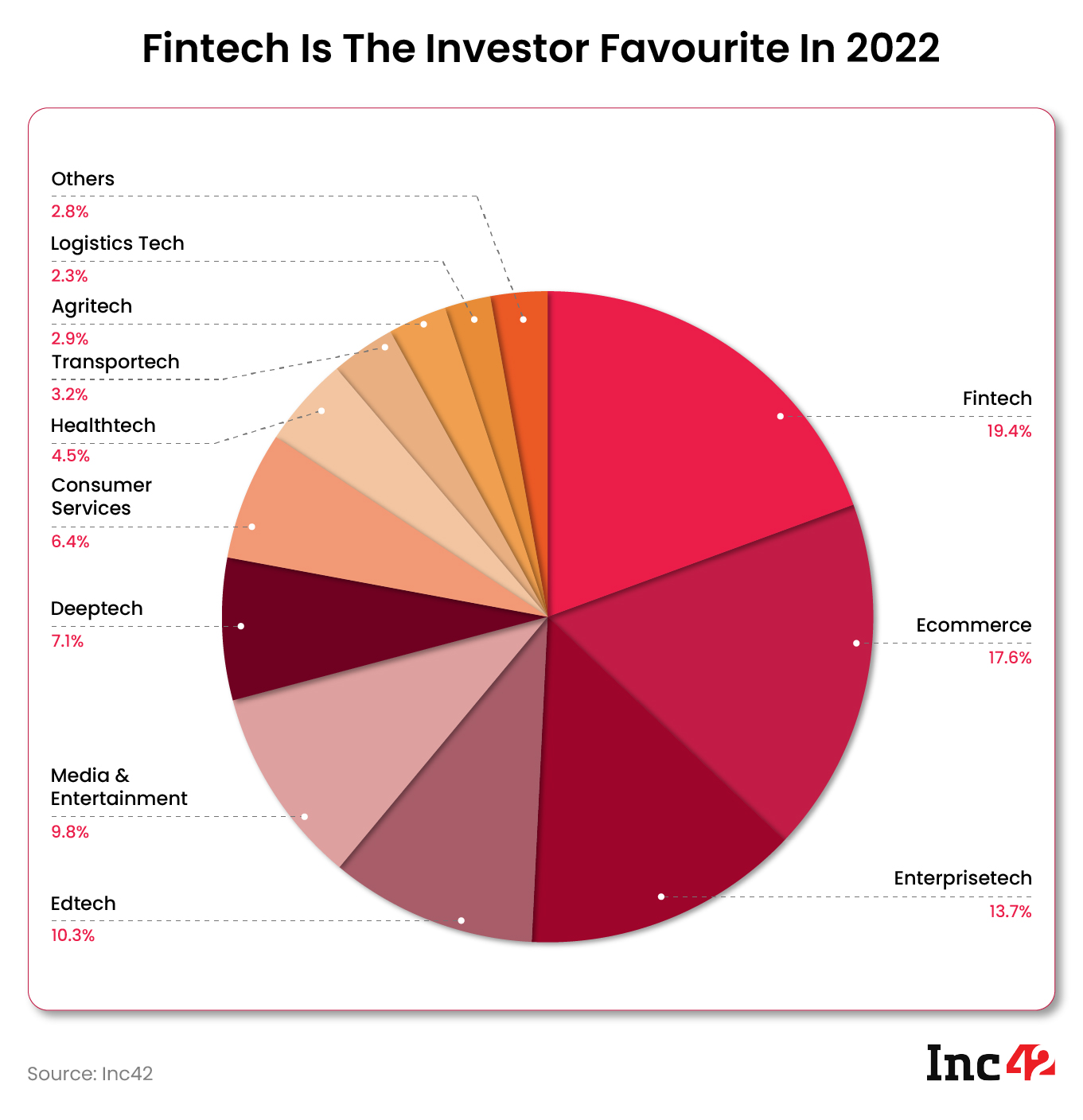

Fintech startups have attracted the most investment ($3.82 Bn) among the different startup sectors, followed by ecommerce ($3.47 Bn) and enterprisetech ($2.71 Bn)

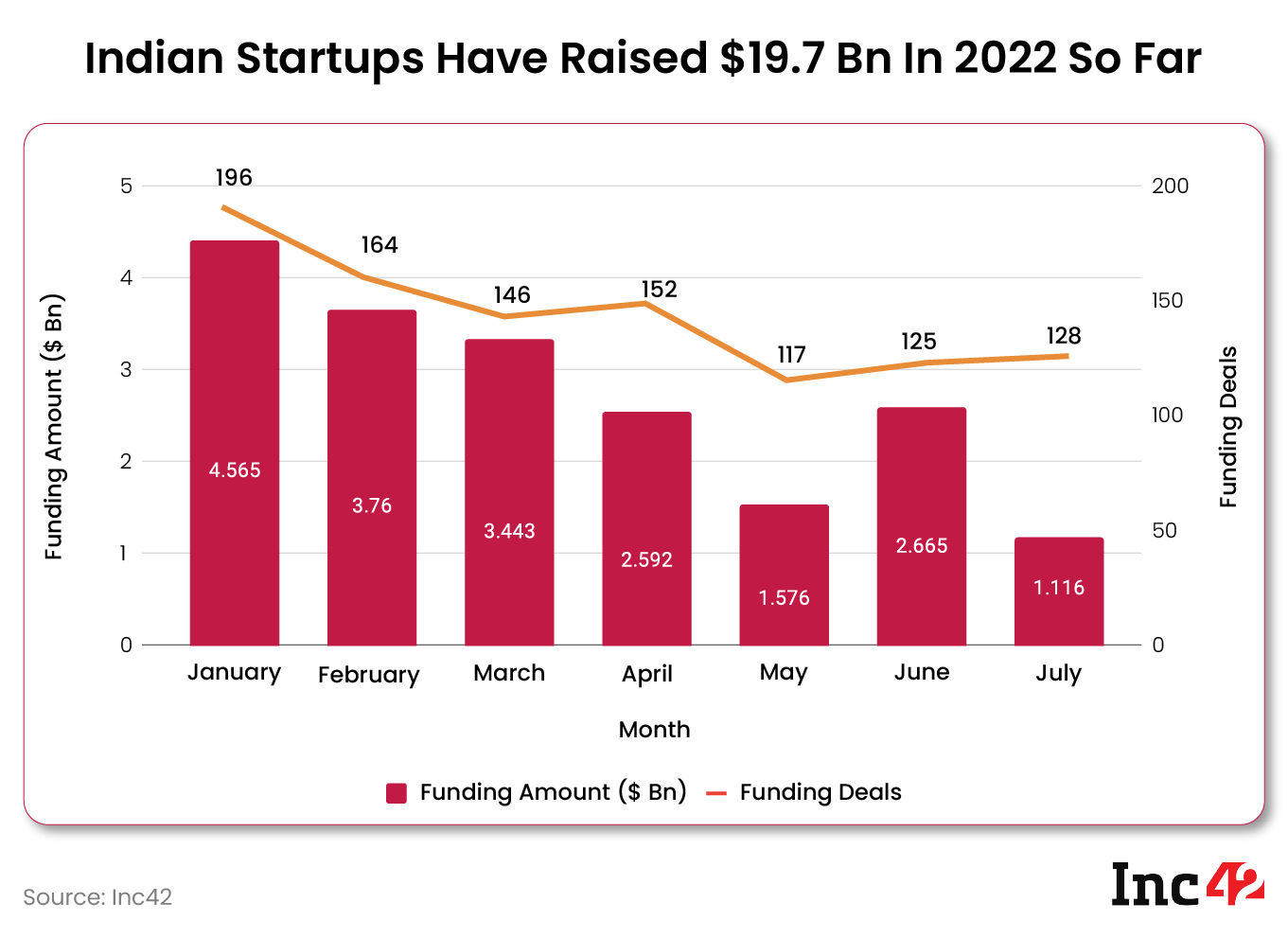

Between January and July 2022, startup funding has reduced by 76%, going down from $4.6 Bn in January to $1.11 Bn in July

Counterintuitively, $12.3 Bn worth of funds have been launched or announced across 76 funds over the first half of 2022 for Indian startups

Seven months in and 2022 has already proven itself to be a tumultuous year for Indian startups after the dizzying heights of post-Covid euphoria that was 2021. In the seven months of 2022, Indian startups raised $19.7 Bn in funding, according to Inc42 data.

The first quarter of 2022 rode the momentum in funding that was created towards the end of last year. In Q4 2021, Indian startups raised $14.5 Bn, while in Q1 2022, around $12 Bn was raised, reporting a 17% decline. However, startup funding has been far from consistent.

The best month for startup funding this year was January; as it has been downhill ever since, with the exception of June. Between January and July, startup funding has reduced by 76%.

By contrast, in the first seven months of 2021, Indian startups raised $21.26 Bn in funding, about 8% higher than the 2022 figures. However, from August to December of 2021, Indian startups raised about as much as they did between January and July.

It will be interesting to see if the country’s startup ecosystem can emulate the stellar performance of 2021.

Nevertheless, while startup funding in 2021 followed an upward trajectory, 2022 has been anything but smooth. July 2022 was the worst month on record since January 2021; the last 17 months have had better funding than July 2022.

Talking about investment trends over the last year, fintech startups have attracted the most investment ($3.82 Bn) among Indian startups, followed by startups in ecommerce ($3.47 Bn) and enterprisetech ($2.71 Bn).

And amid whispers of a funding slowdown, whether continually reducing funding is a telling sign is still up for debate. Nevertheless, marquee investors including Sequoia, BEENEXT and Y Combinator have told their portfolio startups to prepare for extended periods of time without funding coming in.

Here, it is prudent to mention the multiple factors that have contributed to reducing startup funding.

Starting in January, a global sell-off pressure impacted the public equity markets, resulting in a global slump in the performance of all kinds of stocks, new-age tech startup stocks included.

After Russia invaded Ukraine, the sanctions imposed by the US on Russia have resulted in the US Dollar getting stronger, achieving parity with the Euro and reaching INR 80 per dollar.

This prompted the US Federal Reserve Bank to push up interest rates twice this year, making debt more expensive for everyone and reducing liquidity in the market.

This reduced liquidity has thus impacted startup funding, as investors are siphoning money out of India to safe havens.

However, in a wholly counterintuitive manner, $12.3 Bn worth of funds have been launched or announced across 76 funds over the first half of 2022 to invest in Indian startups.

While 2022 seems more or less on track to replicate or at least emulate the funding trends of last year, the fact remains that the global macroeconomic situation is too complex to gauge the direction of funding at this point in time with any certainty.